We had talked about the market volatility in our June quarter newsletter, and it certainly has not let up since! What caused this recent bout of extreme volatility where markets have moved up and down by 1% to 2.5% in day? Generally, summer holidays in the US and Europe mean lower trading ... Read more

Update on the Recent Banking Crisis-by Aziz Meherali CFP —16 March 2023

Regulators announced the closure of Silicon Valley Bank on March 10, an institution that specialized in providing banking and financial services to the technology and life sciences industries as well as private equity and venture capital firms. “Nearly half” of U.S. venture‑backed technology and ... Read more

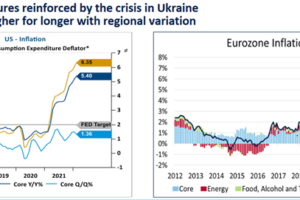

Chief Economists’ Forum -14 Feb 2023

We attended the Chief Economists’ Forum Breakfast yesterday. As always, the line-up of speakers was exemplary. The general consensus was that the US will be in a recession later this year, albeit a mild one, whilst Europe is already in one. Australia, once again, might be the “Lucky Country” and ... Read more

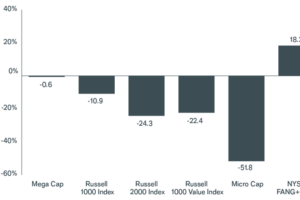

Volatility is King! —by Aziz Meherali

As we have been sharing our view that volatility will remain stubbornly high in 2022, the S&P 500 has gained or lost 2% or more in a day some 32 times so far in 2022, compared to 24 such days in all of 2021! The uncertainty of Fed action to curb inflation and raise rates is causing much ... Read more

A Much Needed Bout of Optimism — by Aziz Meherali

Firstly, I hope you are all well and keeping safe. There is much pain and suffering in the world today, exacerbated by Covid-19. Whilst it continues to plague the world, there is sunshine behind the clouds --- we just have to persevere for the clouds to pass as they always do! I am writing ... Read more

Gamestop and Market Views — by Aziz Meherali CFP

There has been quite a lot of commotion around the recent Gamestop trading activity and has garnered a lot of media attention. Let us look at what happened. Short selling is when an investor borrows stock and then sells that stock on the stock market. They do this because they take the view that ... Read more

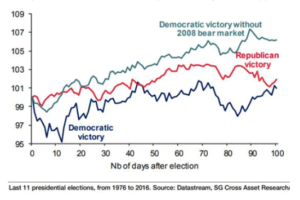

Are we at a precipice for change in equity markets? —Aziz Meherali CFP

Yesterday, in a speech, RBA assistant governor Michele Bullock warned that more businesses would go under resulting in a negative impact on bank balance sheets. She stated that the economic recovery from this recession would be “unpredictable and uneven”. She further stated, “There will be rising ... Read more

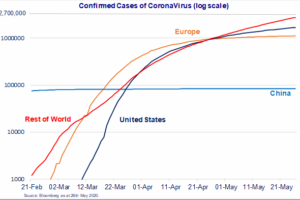

Covid-19 and Markets by Aziz Meherali

We are in unprecedented times where Central Banks globally are artificially inflating asset bubbles to stop significant debt levels from impacting markets and working at keeping the whole system afloat. Given zero interest rates and very low inflation, the US Federal Reserve will continue its asset ... Read more

Fortitude and Resilience—by Aziz Meherali

Firstly, and most importantly, we hope you are all keeping safe and well during these trying times in our lives. Let’s hope 2020 turns out to be a low-point when we look forward in time. Equity markets have remained resilient despite Covid-19 still increasing and a second wave looks more and more ... Read more

Optimistically Cautious — by Aziz Meherali

The virus is raising its ugly head again in China and continuing to spread its claws around the world. China, pressured now not only in the South China Seas but also at its borders with India, is becoming increasingly hostile with its neighbours as well as trading partners, asserting both its ... Read more