As we have been sharing our view that volatility will remain stubbornly high in 2022, the S&P 500 has gained or lost 2% or more in a day some 32 times so far in 2022, compared to 24 such days in all of 2021!

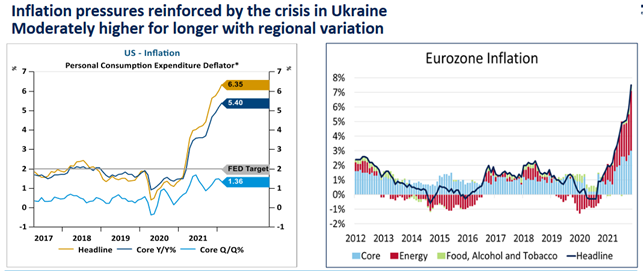

The uncertainty of Fed action to curb inflation and raise rates is causing much consternation around global markets, fueling this volatility.

The U.S. economy unexpectedly contracted in the first quarter as COVID-19 cases surged again, and government pandemic relief money dropped.

This first decrease in gross domestic product since the short and sharp pandemic recession nearly two years ago, was mostly driven by a wider trade deficit as imports surged, and a slowdown in the pace of inventory accumulation.

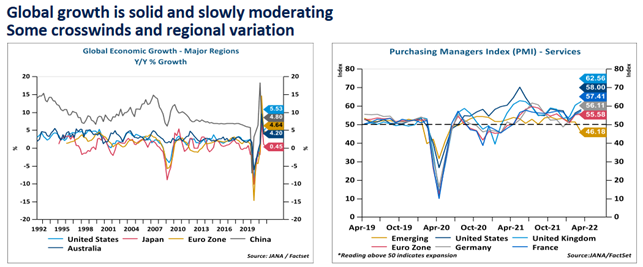

Supply chain disruptions and labour shortages, not just in the US but around the world, are causing economic disruption. The Zero Covid policy in China is now starting to increase uncertainty to the global growth outlook, fueling further volatility

The Ukraine war, China’s COVID lockdowns and surging inflation have weighed on the outlook for the global economy, with surging volatility ahead of the Federal Reserve’s May meeting next week. Market expects a 50-basis-point rate hike.

Energy price inflation is now seeping into food costs, transportation, manufacturing, and other industries around the globe. The longer the Russian invasion of the Ukraine continues, the greater the probability of a recession in Europe which is very heavily dependent on Russia for its energy needs.

However, fundamentals in corporate America are still very sound. Overall, first-quarter earnings have been better than expected, with 81% of the 237 companies in the S&P 500 that have reported results so far beating Wall Street expectations. Typically, only 66% of companies beat estimates, according to Refinitiv data.

Australia, similarly, is in good shape and likely to benefit from the surge in energy and commodity prices. Whilst we have been caught behind, in my view, the interest rate cycle, the ensuing increase in interest rates will provide some headwinds for our GDP. However, this is likely to be offset by our expanding export base to supply energy and agricultural products to Europe due to the disruption of supply from Russia and Ukraine. This should also help to diversify our customer base from a historically heavy dependence on China.

Economic growth continues above trend but slowly moderating towards pre COVID trend. The near-term outlook continues to be supported by the reopening of global borders and markets and increased demand for goods and services due to pent up savings during the pandemic.

The fundamentals of diversification are increasingly important in portfolio construction. In every risk there is also an opportunity. Concerted stock selection and investing fundamentally is likely to add value and mitigate risks in this volatile and uncertain market. It is also most important to adhere to the long-term investment strategy and not succumb to fear and ‘noise’ in the media. Staying the course (on a sound and diversified investment strategy) has proven to be value accretive over the longer term.

“The true investor welcomes volatility—a wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses.” —Warren Buffet