We are in unprecedented times where Central Banks globally are artificially inflating asset bubbles to stop significant debt levels from impacting markets and working at keeping the whole system afloat. Given zero interest rates and very low inflation, the US Federal Reserve will continue its asset purchase program at least for another 12 months.

Markets are uneasy with the US failing to come to a Phase 5 stimulus package so far, the US election looming, US and China relations deteriorating, and Covid-19 continuing to create havoc around the world.

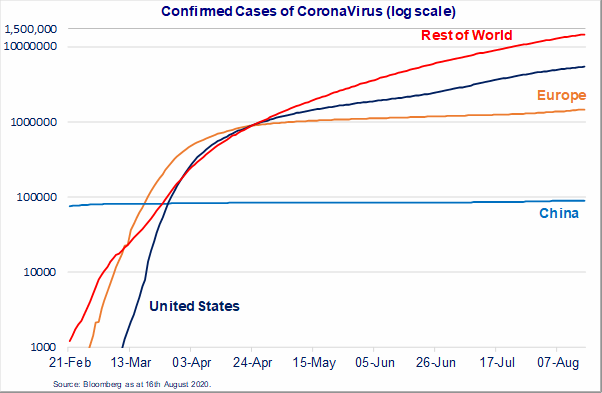

The Global Covid-19 cases are at just under 22 Million and increasing. The death rate stands at 773,000 but the daily rate is increasing unfortunately.

Among countries, the most cases are in the US (5.4M with 11 states yet to report), followed by Brazil (3.34M), India (2.59M), Russia (920K), and so on. Australia’s confirmed cases rose to 23,300 yesterday, placing us 69th in terms of total infections globally.

This is continuing to cause economic hardship through closure of economies and businesses around the globe in the attempt to contain the spread of this virus. The stopping and restarting of economies cannot be our method of controlling the spread longer-term. This has caused untold economic stress resulting in a significant increase in mental health issues, suicide, and, in third world countries where one does not eat if one does not work, death due to starvation.

Given the uncertainty around a cure and timing of a vaccine, it is likely that we will need to learn to live with this covid-19 virus for many months (and possibly more) to come.

We all have to learn to take every precaution such as wearing masks in public, hand hygiene, and isolating only those who are unwell (and off course getting checked and self-isolating when not feeling well) to control the spread whilst still keeping the economy and businesses open.

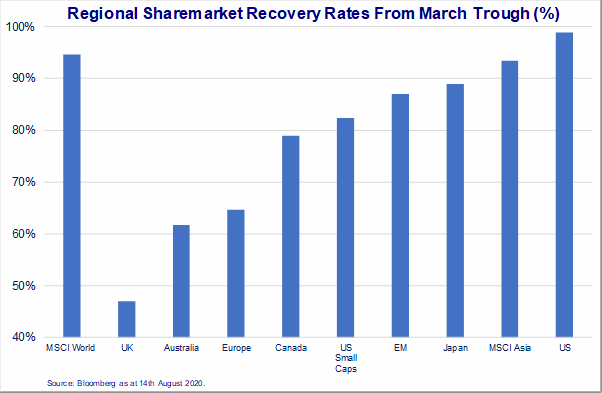

Given the likelihood of increasing defaults, rising unemployment, and likely weak economic recovery, markets should not be on the verge of record highs and recovering back to pre-covid-19 levels as they have in some cases.

The chart below, from Bloomberg dated 14th August, illustrates the variance in the recovery of different countries. Some, like the US, have close to recovered entirely (98.8%) to their pre-covid-19 highs whilst others, like Australia are only at 63% levels.

Therefore, it would lead one to believe that there are still pockets of opportunities left given the uneven global recovery as show in the chart above. However, being cautious in times like these is highly warranted.

With regards to portfolio management during these uncertain times, the basics of diversification and a strong focus on quality is going to be paramount in maintaining wealth into the future. Having cash to access opportunities during market volatility should be part of the model now, to enable portfolios to both recover from any further downturns and benefit from the uptick.

“Invest for the long haul. Don’t get too greedy and don’t get too scared.”

— Shelby M.C. Davis (a successful US money manager and philanthropist)