Media Release Number2024-05 Date19 March 2024 At its meeting today, the Board decided to leave the cash rate target unchanged at 4.35 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.25 per cent. Inflation continues to moderate but remains ... Read more

Economic and Market Commentary by Aziz Meherali CFP

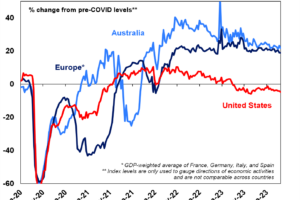

We have had a very positive start to 2024 despite all the global turmoil currently underway, especially in the Ukraine and the Gaza. Whilst the market rise is welcome, human losses are unbearable and hard to stomach. We continue to hope that peace prevails eventually over these desperate ... Read more

What Government Assistance is available to First Home Buyers? by David Agius

Buying your first home will likely be the largest financial commitment most people will enter. As such, it pays to be aware of the various State and Federal government grants and schemes that are available to help first-time home buyers. First Home Buyers Assistance Scheme One of the ... Read more

How to improve your gut health

We’re becoming increasingly aware of the role our gut plays on our overall health. With so much information out there, it can be overwhelming to know what’s true or false. So how do we improve our gut health? What’s the difference between good bacteria and bad bacteria? Are gut health supplements ... Read more

Statement by the Reserve Bank Board: Monetary Policy Decision —6th February 2024

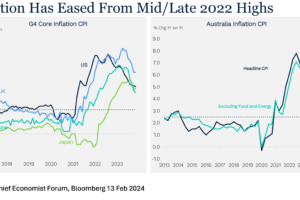

Number2024-01 Date6 February 2024 At its meeting today, the Board decided to leave the cash rate target unchanged at 4.35 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.25 per cent. Inflation continues to moderate but remains high. Inflation continued ... Read more

Statement by Michele Bullock, Governor: Monetary Policy Decision

Number2023-35 Date5 December 2023 At its meeting today, the Board decided to leave the cash rate target unchanged at 4.35 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.25 per cent. Last month, the Board increased interest rates by 25 basis points, ... Read more

Economic and Market Commentary by Aziz Meherali

According to the latest monthly consumer price index (CPI) indicator released by the Australian Bureau of Statistics (ABS) on Wednesday, 29th of November, inflation rose by 4.9 per cent in the year to October. The October CPI indicator was under market expectations for a 5.2 per cent lift and was ... Read more

Granny Flats by David Agius

The humble granny flat is a making a renaissance across the suburbs of Australia. With residential rents continuing to rise and the affordability issues for young people looking to purchase their first home, granny flats have become a popular solution. The case for Granny Flats What do we ... Read more

Brain basics: what is neuroplasticity and how can it help keep your amazing brain healthy?

One of the most incredible and complex parts in the human body, the brain is approximately 1.3kg of intelligence, memory, body movement and behavioural control. And as we get older, there are things we can do to keep our brains healthy – like memory games or learning to play an instrument. In ... Read more

Statement by Michele Bullock, Governor: Monetary Policy Decision —7 Nov 2023

Number2023-30 Date7 November 2023 At its meeting today, the Board decided to raise the cash rate target by 25 basis points to 4.35 per cent. It also increased the interest rate paid on Exchange Settlement balances by 25 basis points to 4.25 per cent. Inflation in Australia has passed ... Read more

- 1

- 2

- 3

- …

- 43

- Next Page >>