According to the latest monthly consumer price index (CPI) indicator released by the Australian Bureau of Statistics (ABS) on Wednesday, 29th of November, inflation rose by 4.9 per cent in the year to October.

According to the latest monthly consumer price index (CPI) indicator released by the Australian Bureau of Statistics (ABS) on Wednesday, 29th of November, inflation rose by 4.9 per cent in the year to October.

The October CPI indicator was under market expectations for a 5.2 per cent lift and was down from 5.6 per cent in the 12 months to September.

The ABS reported that the most significant contributors to the increase in October were housing (+6.1 per cent), food and non-alcoholic beverages (+5.3 per cent) and transport (+5.9 per cent).

This, hopefully, provides some much-needed relief that the Reserve Bank may hold off on a further rate hike at their next rates’ decision on the 5th of December this year.

The potential for rates on hold coupled with markets having rallied over the past few may be the panacea for a fairly ‘flat’ (and somewhat depressing) 2023 going into 2024.

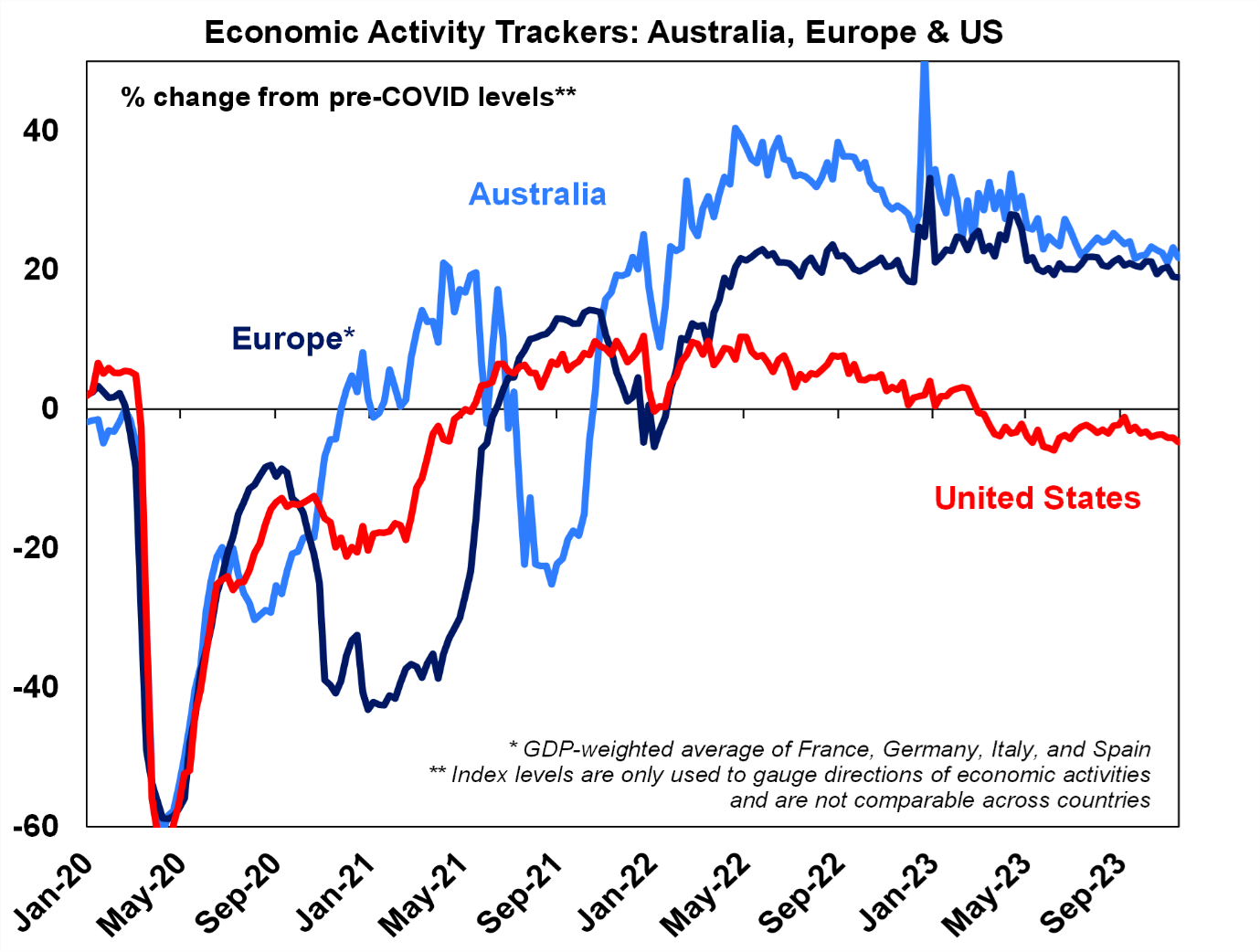

Economic data has been mixed across the Globe and most central banks seem to be in no rush to raise interest rates further. Economic activity remains relatively stable, although decreasing somewhat.

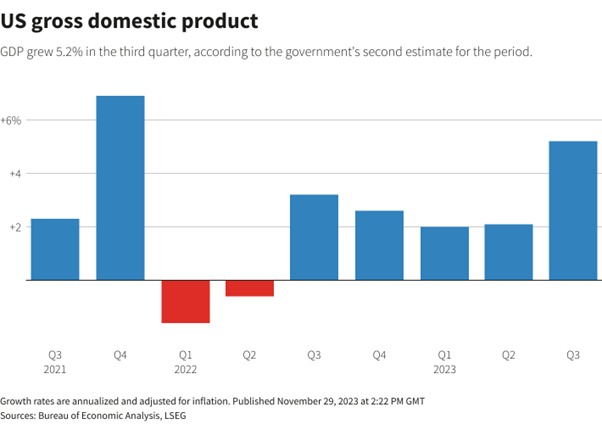

US GDP print on Wednesday, 29th of November was above expectations causing markets to track largely sideways. They were up and then down slightly on the close as concerns around commentary from various Federal Bank speakers alluded to a vague possibility of rates being higher for longer given the positive print on GDP. The US economy is still showing signs of resilience despite the efforts by the Fed to cool the economy in order to subjugate inflation.

Traditionally, markets tend to rally into the Christmas season and momentum seems to be moving that way. However, economic activity has slowed broadly over the past six weeks, while labour demand also has backed off and price increases have eased, the Federal Reserve reported Wednesday in its periodic “Beige Book” summary.

The report showed that consumers showed more “price sensitivity.” In the jobs market, firms reported an easier time finding workers and were more comfortable laying off underperformers.

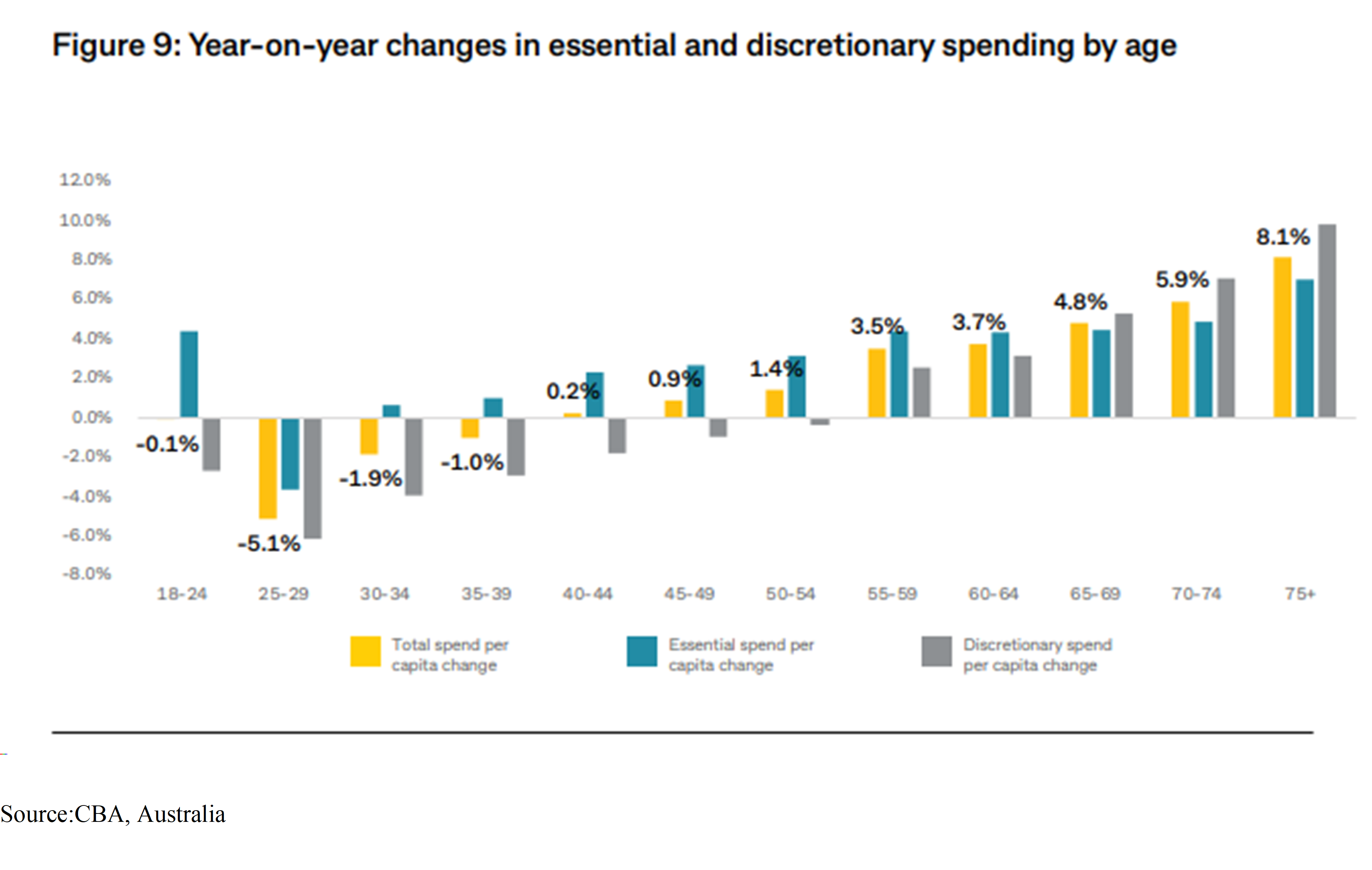

On inflation, the report said prices for construction materials declined, though utilities and insurance costs rose. In general, the report saw businesses saying they see “moderate” price increase continuing into 2024. What is also interesting is the discretionary spend demographics (see the chart below): This illustrates part of the concerns. Whilst the upper age group (45 and up) has increased their discretionary (non-essential) spending, the younger cohort’s spending has decreased. This is largely due to cost-of-living pressures and mortgage stress. This is also generally the age group that have a larger share of the discretionary spend that impacts on GDP. Excess household cash or savings is now getting depleted, and the lagged impact of the interest rate hiking cycle is now starting to take a bite. Therefore, this would mean a curb in spending and hence, impact on the economy.

This illustrates part of the concerns. Whilst the upper age group (45 and up) has increased their discretionary (non-essential) spending, the younger cohort’s spending has decreased. This is largely due to cost-of-living pressures and mortgage stress. This is also generally the age group that have a larger share of the discretionary spend that impacts on GDP. Excess household cash or savings is now getting depleted, and the lagged impact of the interest rate hiking cycle is now starting to take a bite. Therefore, this would mean a curb in spending and hence, impact on the economy.

On the positive, structural changes like onshoring, infrastructure re-build and spending, and growth of AI (artificial intelligence) should provide underlying support for growth going forward. The higher interest rate environment is also a positive for fixed interest investments, reflected in higher passive income levels.

As liquidity dries up, investments will need to take into account both quality and price. Value and risk will matter, and fundamentals of investment philosophy will reign true again.

Therefore, we are not out of the woods just yet! There is a definite possibility of a recession in the US and subsequently in Australia. Even if the base case is for this recession to be a mild one, it does mean we need to be more cautious with our investment exposures and remain wedded to our longer-term, strategic asset allocation principles and not get caught up in the ‘noise’.

Rest assured, we have our eye on the ball and monitor not only the suite of managers in our portfolio on a very regular basis, but also incorporate the macro view when looking at our strategic asset allocation strategies.

To close, as always, I leave you with some quotes to ponder over.

“Life has immense analogy with stock market. It is volatile, but if you stick on long enough, it has the potential to reward you with handsome returns in the long run.” – Manoj Arora (The Autobiography Of A Stock)

“Outperforming the market with low volatility on a consistent basis is an impossibility. I outperformed the market for 30-odd years, but not with low volatility.” – George Soros

“The first rule of investment is ‘buy low and sell high’, but many people fear to buy low because of the fear of the stock dropping even lower. Then you may ask: ‘When is the time to buy low?’ The answer is: When there is maximum pessimism.” – Warren Buffett