We have had a very positive start to 2024 despite all the global turmoil currently underway, especially in the Ukraine and the Gaza. Whilst the market rise is welcome, human losses are unbearable and hard to stomach. We continue to hope that peace prevails eventually over these desperate times.

We have had a very positive start to 2024 despite all the global turmoil currently underway, especially in the Ukraine and the Gaza. Whilst the market rise is welcome, human losses are unbearable and hard to stomach. We continue to hope that peace prevails eventually over these desperate times.

We did not anticipate markets to rally into Christmas in 2023 given the uncertainties around the Globe but are happy that they did.

The question on everyone’s minds is “where to from here?”

Developed market growth was not all consistent with positive returns and the US, Japan, and parts of the Eurozone were resilient. However, Japan, Germany, and the UK are now seen as declining. China, which had an abysmal year with regards to its markets, is now seen as turning the corner (hopefully). However, given their property market woes, this may take some time to be accretive to global GDP and growth.

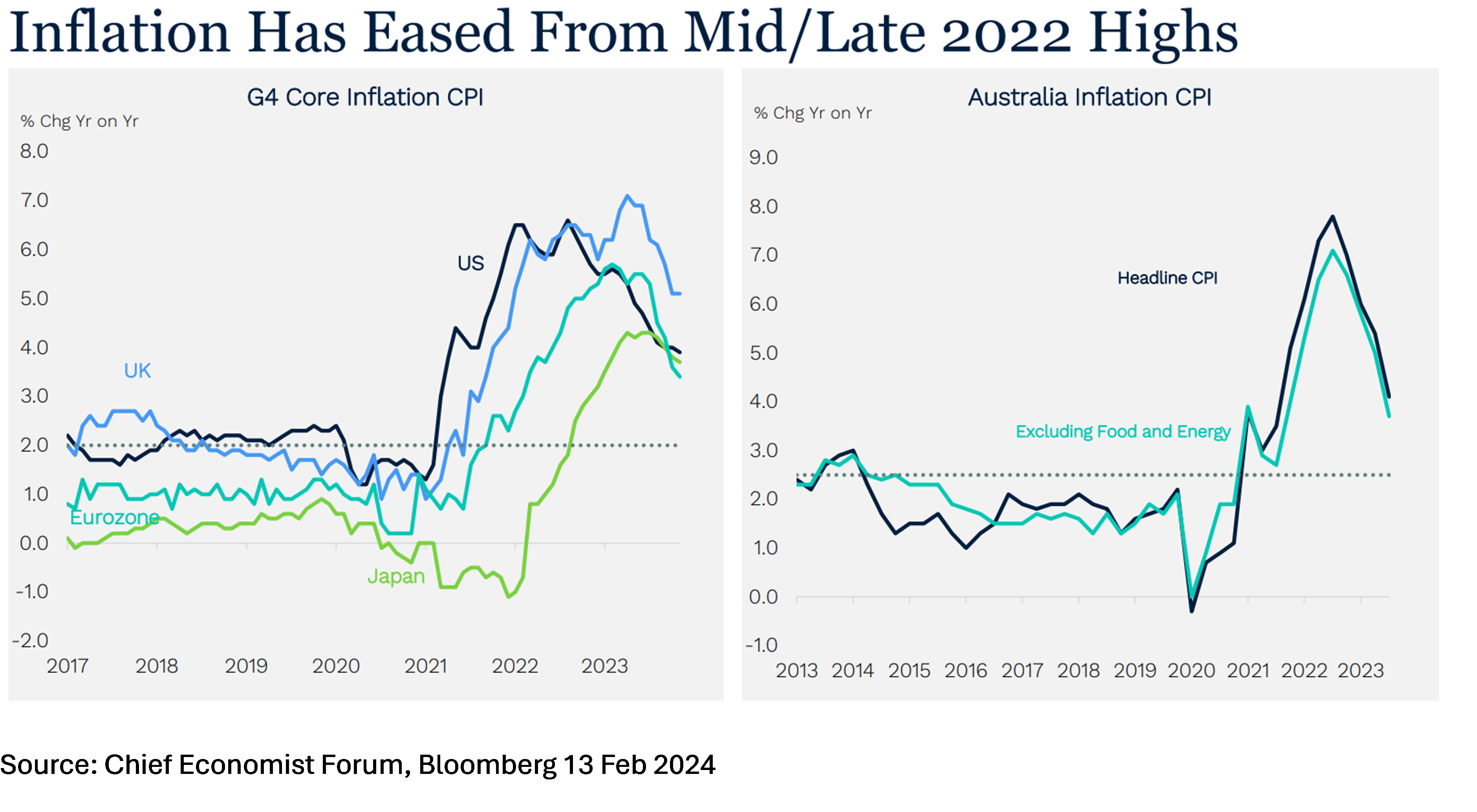

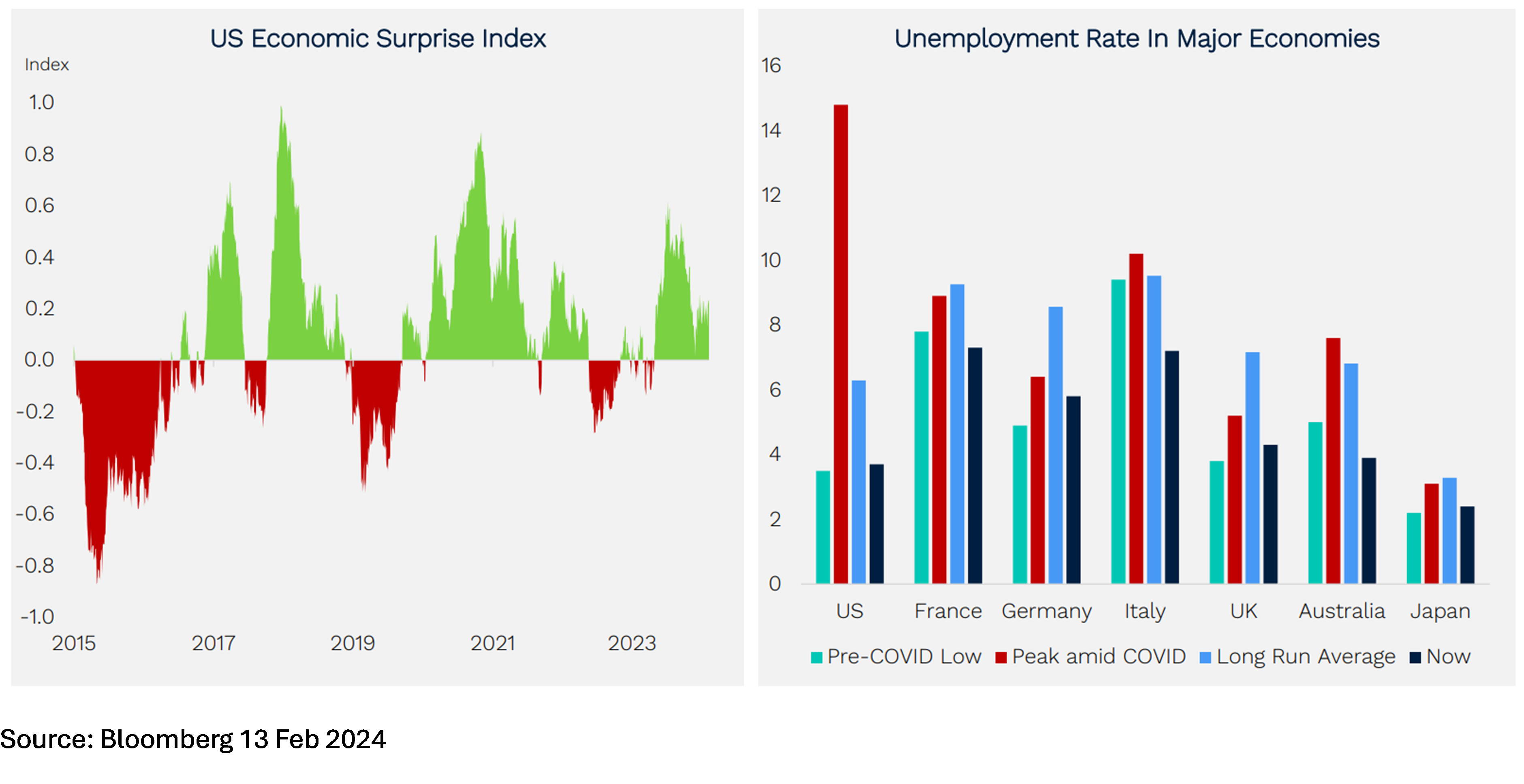

A positive backdrop is the easing inflation around the world which many translate into an easing monetary policy and decreasing interest rates. Markets tend to be overzealous in pricing the positive impact and voracity of these rate cuts. However, and in particular the US, services inflation and growth numbers have surprised on the upside causing some pull-back in interest rate cut assumptions for 2024.

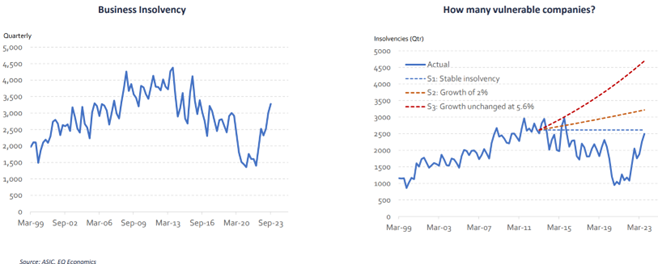

Cost of living pressures and high interest rates have caused consumers to reign back spending, resulting in weaker business activity and the PMI activity index level is consistent with a soft-landing scenario. This will further depend on to what extent business activity slows down. Already, some of the largest multinationals, especially in the US, have informed the market of job cuts into 2024 and 2025. We see business insolvency increasing, causing further downside risk to GDP which may eventually be a catalyst for an equity market re-adjustment.

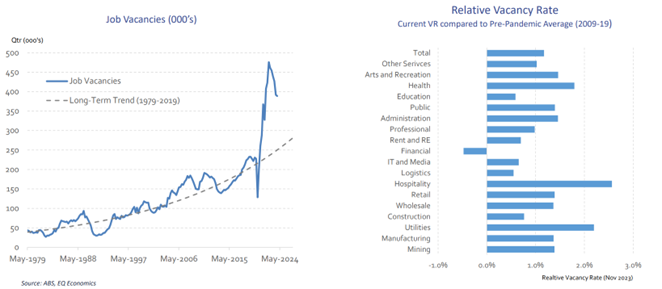

Although job vacancies have fallen from the peak by approximately 20%, it still remains well above long-term trend. This does provide a positive backdrop to GDP —as long as there is significant employment, continued spending will mean that economies will remain in growth mode, albeit declining from previous highs. All of this leads to a soft-landing scenario.

Company reporting that finished in the US a week or so ago has been positive with over 80% reporting above expectations. This was a surprise as well. However, there are headwinds as well, in particular geopolitical risks.

Almost 60% of the world is due for elections this year. In the US, if Trump is successful, applying further tariffs towards imports from China as promised may be damaging to the Chinese economy with repercussions of trade wars across the Asia-Pacific and impact on Australia given our ties to the US. A trade war would generally be negative for efficiency and inflationary for cost of goods as countries look inward for their resources, even at higher costs. This would also mean tighter margins for businesses and potentially a reduced profit outlook. An ensuing trade-war could also have political repercussions. Some suggest that a decreasing reliance on the West for trade, China may become less concerned about invading Taiwan as it has less to lose, so to speak.

Whilst we have already seen Chinese companies preparing for this with onshoring their manufacturing facilities into markets they export to, what politicians do to circumvent this is open for interpretation and results in further uncertainties. Examples of companies onshoring are the likes of auto and battery production with firms like BAYD, Great Wall Motor and Changan already building manufacturing factories overseas.

The other risk is the escalation of the Israeli/Hamas war in the Middle East. This may result in an increase in the price of oil, further issues with the trade route disruption at the Suez Canal, etc. However, at this point, the likelihood of this remains very low. The Ukraine/Russia war continues to draw funding needs from the West. A US backdown in funding approval would mean dire consequences for not only the Ukraine in winning this war but would further embolden Putin in continuing his advance next into Moldova, another of its neighbours who are not part of NATO. Again, another headwind potentially.

There are always checks and balances when you look at a balance sheet. Where there are negatives, there are also positives. There are also some tailwinds globally and in Australia.

A strong labour market has been positive for GDP but also banking and credit issues. Annual household savings have been high and non-performing bank loans have remained low. Therefore, banking and credit is well positioned for resilience into 2024 and beyond. Labour productivity is also trending upwards, which is very welcome.

There are also pockets of inequity in Global equity markets. For example, Emerging countries and I dare say China have not performed as well in 2023 and year-to-date in comparison to the US. Furthermore, a continuing move away from reliance on China for the West means emerging markets are net beneficiaries. These represent investment opportunities but one needs to be discerning in terms of investing in industries where political uncertainties are at their lowest in these markets. We also see private equity markets, some segments of the property market, and infrastructure as presenting opportunities based on valuations in comparison to the listed space as well as in comparison to other asset classes.

We will keep our ears to the ground and navigate markets to mitigate risks as much as possible and enhance returns with a long-term view. We will continue to make changes based on macroeconomic views as well as looking at where we can reduce risks in our portfolios and, of course, also enhance returns in taking on opportunities as they present themselves.

As always, I leave you with some pearls of wisdom below:

“With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.” — Carlos Slim Helu

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” — George Soros

“In investing, what is comfortable is rarely profitable.” — Robert Arnott