The virus is raising its ugly head again in China and continuing to spread its claws around the world. China, pressured now not only in the South China Seas but also at its borders with India, is becoming increasingly hostile with its neighbours as well as trading partners, asserting both its formidable political as well as economic strength to the detriment of anyone who would question them. This adds to uncertainty of global trade and potentially impacts the depth of the economic recovery post a Covid-19 world.

However, equity markets have found wind beneath their wings and continue to rally. Volatility and large momentum swings have also become commonplace these days. The question on everyone’s minds is whether this rally will continue or will there be a second correction/set-back before markets find stability.

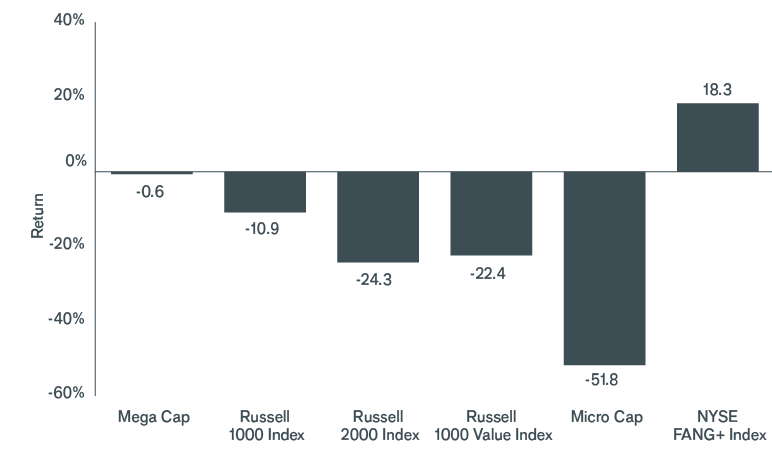

It is interesting to note that not all markets have performed quite as well post the March 23 lows on the back of the covid-19 pandemic. The chart below illustrates this quite clearly:

Source: Bloomberg, data are year to date through 15 May 2020. NYSE FANG+ is an equal-dollar weighted index comprised of select highly traded mega-cap technology and consumer discretionary stocks.

As the chart above illustrates, it is largely the technology stocks that have done well during this pandemic. The secular trend we saw over the past few years has only accelerated during Covid-19. The use of technology, online sales and payments, and themes associated with technological innovation, for instance, have accelerated in the face of social distancing.

These behavioural changes will likely remain entrenched after the pandemic, given individuals have become more comfortable using the services and accustomed to this convenience as well. Therefore, it is likely that these companies may continue to provide growth opportunities well into the future, post a Covid-19 world.

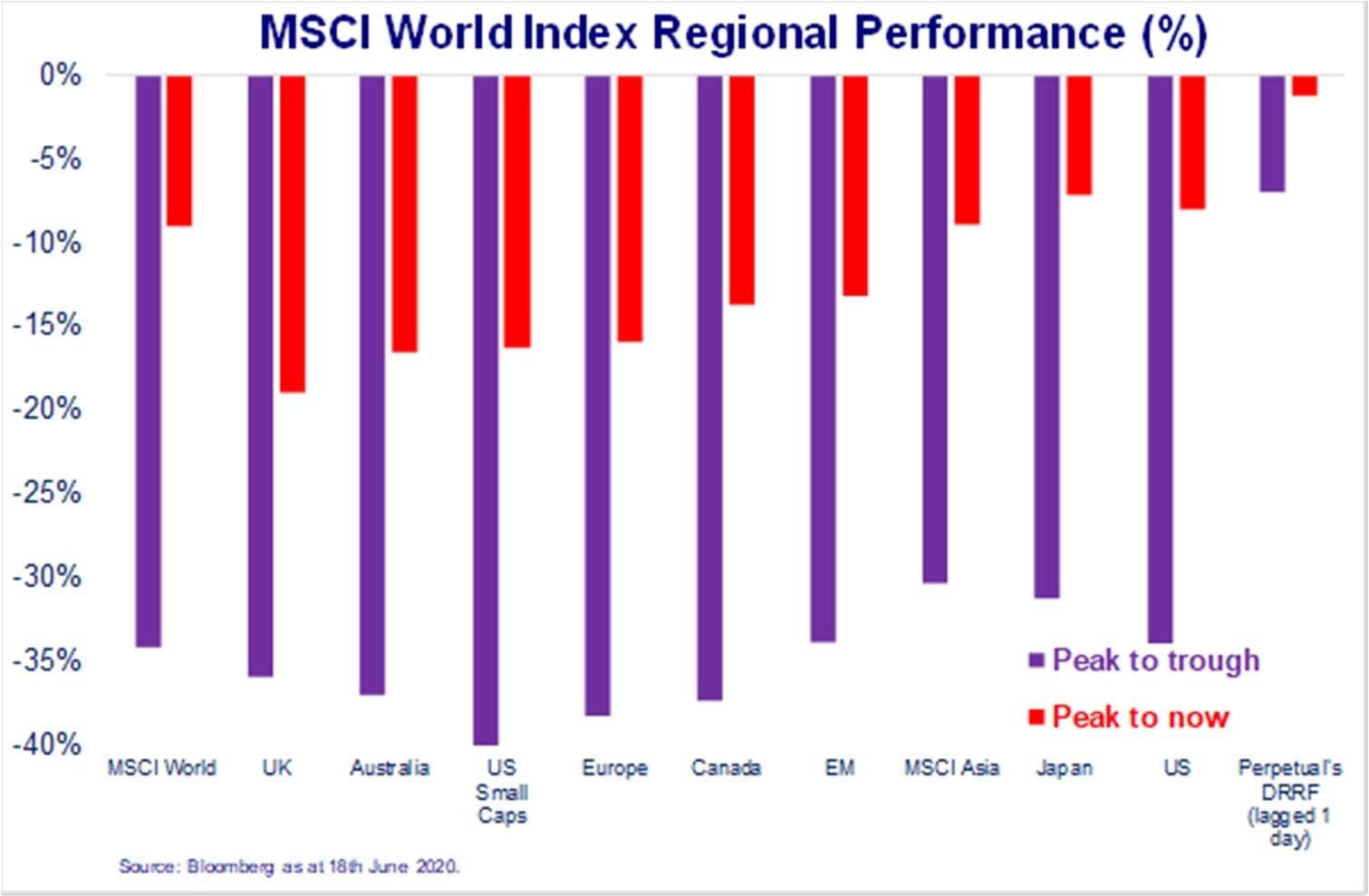

Despite the recent rally in equity markets, we are still below the peak reached towards the end of February this year. The chart below illustrates this.

Whilst the markets have rallied hard over the past couple of months, it is prudent to remain cautious. The reasons for this are several fold. Firstly, despite optimism remaining high for a cure, there is no cure for this disease yet. Secondly, the economic impact of the early shutdown and disruption of global trade is not fully known at this point. It will be interesting to see the impact once the government incentive programmes around the world come to an end, such as the jobkeeper here in Australia in September. This may cause some permanent job losses and business failures. Thirdly, a resurgence of the virus and the possibility of a second economic shutdown is not completely out of the realm of possibility, albeit not a high probability at this stage and not our base case. This would cause untold economic damage, not to mention the human side of the equation.

However, we remain somewhat optimistic that, given our experience with this virus, we will manage this better should a second wave hit. We also remain optimistic of a cure in the not-too-distant-future given the huge focus on this globally and the success of a few second stage trials already. Hence why we have largely remained invested whilst ensuring there is enough dry powder to take any opportunities when they present themselves.

We hope you all remain safe and keep your spirits high. Have a great weekend!