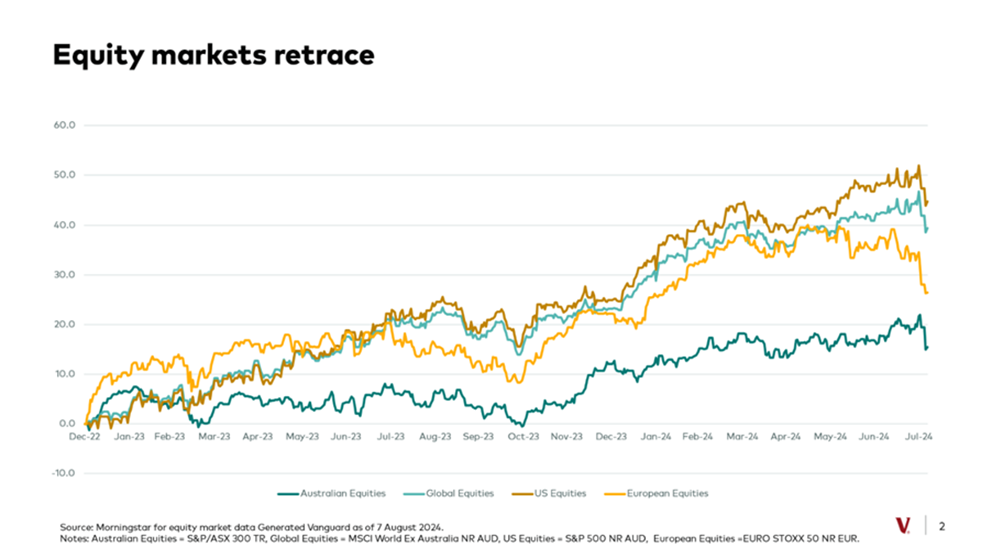

We had talked about the market volatility in our June quarter newsletter, and it certainly has not let up since!

What caused this recent bout of extreme volatility where markets have moved up and down by 1% to 2.5% in day?

Generally, summer holidays in the US and Europe mean lower trading volumes leading to spikes in volatility. However, according to Vanguard, there were 5 key interconnected drivers of this recent volatility:

- The FOMC announced rates would remain on hold at the conclusion of their July meeting. However, Powell’s comments put a focus on the labour market and indicated that the risks on both sides of their dual mandate were somewhat better than before.

- Following the comments above, the labour market numbers were weaker than expected where only 114,000 jobs were added against an expectation of 176,000. This led to higher-than-expected jobless claims causing concerns around an economic slowdown and recession fears.

- A strengthening Japanese yen and carry trade caused some volatility.

- Tech stocks, which have been trading on high multiples, sold off due to mixed earnings.

- The killing of the Hamas leader in Tehran by Israel increased the likelihood of a wider conflict in the Middle East causing market jitters.

These factors caused equity markets to take risk off the table and for bond yields to be driven up (as a safe haven from stocks). This further highlights the need to diversify portfolios to ensure some consistency of overall returns where when equities correct, generally fixed interest rallies and provides a buffer.

Last night, the market rallied significantly with the NASDAQ up 2.9%! The sell off seems to have abated for now.

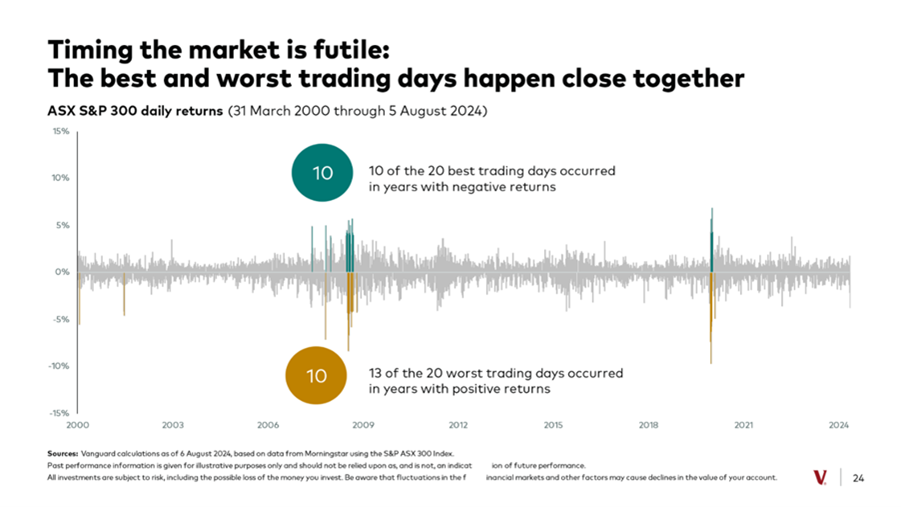

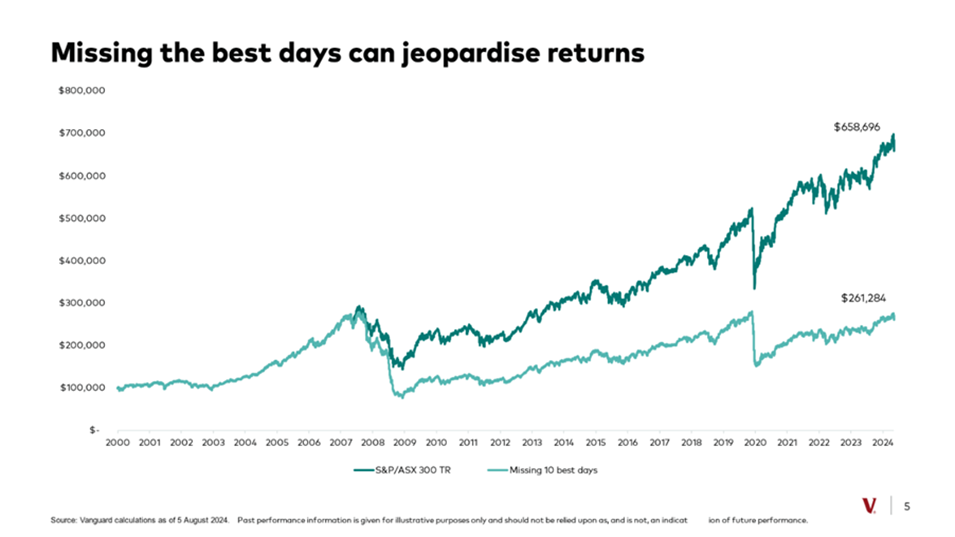

These large market movements can cause significant discomfort to investors. However, it is important not to succumb to making timing decisions around investing and best to stay the course of your longer-term investment strategy based on your chosen risk profile.

It is also important to remember that Bear markets are temporary and have been generally shorter than bull markets over time. As we have always stated and is a very familiar saying—“Time in the market is better than Timing the market”.