Firstly, and most importantly, we hope you are all keeping safe and well during these trying times in our lives. Let’s hope 2020 turns out to be a low-point when we look forward in time.

Equity markets have remained resilient despite Covid-19 still increasing and a second wave looks more and more inevitable in pockets around the world. Until there is a vaccine, we will need to learn to live with this virus around us and take every precaution to ensure the safety of our loved ones and the community at large.

Given the US election around the corner, the increasingly negative political rhetoric between China and the US, and a second round of economic shutdowns due to Covid-19, volatility is likely to remain elevated in the coming months.

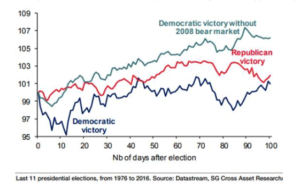

There is a lot of talk with regards to market impact of a Democratic versus a Republican election victory in the US. When we look back at history, the theory that a Democratic win is negative for equity markets and, subsequently, a Republican win is positive is not a proven fact. See the chart below from Société Générale which shows the S&P 500 index performance post an election across a number of days to the first 100 days.

Therefore, and especially given the complications from Covid-19 and the US/China trade war, the lines are further blurred as to the impact of the US elections on equity markets. Policies enacted by the elected party and issues such as employment and survival of companies post the lifting of central bank stimulus packages around the Globe will have a more meaningful impact it would seem. Of course, this is all conjecture based on logic —equity markets are often more driven by sentiment in times of stress. Therefore, without the benefit of hindsight, only one thing is certain — volatility will be high!

We must stay the course with regards to our longer-term objectives and strategic asset allocation and weather this storm with patience, resilience, and fortitude.

Wish you all Good Health and Happiness!