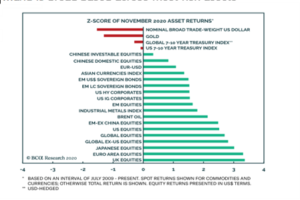

Markets have rallied with great fervour over the last 3 to 4 weeks, posting some of the best months in equity market both overseas as well as here in Australia. The Australian market rose around 10% in November to post its best month in 27 years! What has been a “growth equity” story and surge ... Read more

Statement by Philip Lowe, Governor: Monetary Policy Decision —1 December 2020

Number 2020-32 Date 1 December 2020 At its meeting today, the Board decided to maintain the current policy settings, including the targets of 10 basis points for the cash rate and the yield on 3-year Australian Government bonds, as well as the parameters of the Term Funding Facility and ... Read more

RBA cuts rates to just 0.1% and ramps up quantitative easing – but will it work? —By Dr Shane Oliver, Chief Economist for AMP Capital

A very interesting write-up on the effects of interest rates and quantitative easing as declared by our Reserve Bank in their interest rate decision today. Please click on the link below to read at your convenience. This is a good article for those interested in economic theories around interest ... Read more

Statement by Philip Lowe, Governor: Monetary Policy Decision —3rd November 2020

Number 2020-28 At its meeting today, the Board decided on a package of further measures to support job creation and the recovery of the Australian economy from the pandemic. With Australia facing a period of high unemployment, the Reserve Bank is committed to doing what it can to support the ... Read more

Are we at a precipice for change in equity markets? —Aziz Meherali CFP

Yesterday, in a speech, RBA assistant governor Michele Bullock warned that more businesses would go under resulting in a negative impact on bank balance sheets. She stated that the economic recovery from this recession would be “unpredictable and uneven”. She further stated, “There will be rising ... Read more

Media Release Statement by Philip Lowe, Governor: Monetary Policy Decision

Number 2020-24 Date 6 October 2020 At its meeting today, the Board decided to maintain the current policy settings, including the targets for the cash rate, the yield on 3-year Australian Government bonds, and the parameters for the expanded Term Funding Facility. The global economy is ... Read more

Australia’s “eye popping” budget deficit and public debt blow out – can it be paid off? Does it matter? —Dr. Shane Oliver, Chief Economist for AMP Capital

Please click on the link below to read this article. Australia’s “eye popping” budget deficit and public debt blow out - can it be paid off? Does it matter? ... Read more

Is Volatility the New Normal? by Aziz Meherali

Earnings per share this Financial Year 2020 fell by 20% whilst dividend paid out fell by 26%. This was the same fall as was experienced during the GFC back in 2008. The unemployment rate in Australia is 7.5% whilst the underemployment rate is 11.2%. The unemployment rate in the US is 8.4% as of ... Read more

Elixir is using Docusign

Dear Clients, We are now using DocuSign to allow you to sign documents electronically. Please find enclosed a link to a short video to demonstrate the use of DocuSign and how to execute documents electronically. Please click the DocuSign symbol to access the ... Read more

When risk gets personal

Your personal experiences have likely had a big influence on how risk-averse or - tolerant you are. By Christine Benz - Christine Benz is Morningstar’s director of personal finance and author of 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances and the Morningstar Guide to ... Read more

- << Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 46

- Next Page >>