Markets have rallied with great fervour over the last 3 to 4 weeks, posting some of the best months in equity market both overseas as well as here in Australia. The Australian market rose around 10% in November to post its best month in 27 years!

Markets have rallied with great fervour over the last 3 to 4 weeks, posting some of the best months in equity market both overseas as well as here in Australia. The Australian market rose around 10% in November to post its best month in 27 years!

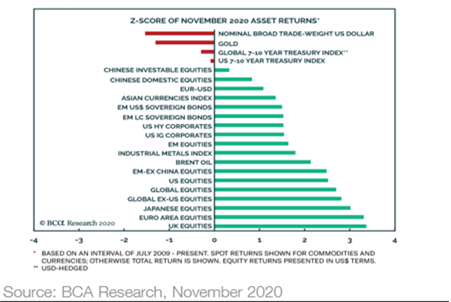

What has been a “growth equity” story and surge over the past few years now seems to have spilled over to ‘value’ sectors, especially energy and, to a far lesser extent, financials. There has been a reversal in negative returns to positive outcomes as you can see in the chart below:

The growth versus value paradigm in equity markets is further illustrated in the chart below. Whilst value has lagged, it is in a similar trend.

Given valuations are at “nose Bleed” levels, economic activity has picked up despite a further resurgence of the covid-19 shutdowns in the US and Europe, especially the UK and France. The loose monetary policy of central banks around the globe and their focus on keeping rates low to assist the economic recovery, gives some additional head room for equity markets to fill! Therefore, there could be further upside in store in 2021.

However, given the market seems to shrug off any ‘bad’ news and rallies on any semblance of good news gives us concern. At some point, reality must sink in, and the markets could take a ‘breather’ albeit temporarily. This would, off course, provide an opportunity to increase equity exposure, both value and growth alike. The difficulty in pin-pointing the timing of this is the angst we must contend with.

Like a lioness (as a male I would use ‘Lion’ but the lioness does all the hunting, and all the work!) having singular focus on its prey, we are eyeing the markets daily for this ‘prize’ — the opportunity to pounce at the market at its time of weakness!

We wish you all a Very Merry Christmas and a Happy New Year!