Earnings per share this Financial Year 2020 fell by 20% whilst dividend paid out fell by 26%. This was the same fall as was experienced during the GFC back in 2008. The unemployment rate in Australia is 7.5% whilst the underemployment rate is 11.2%. The unemployment rate in the US is 8.4% as of August 2020. This is despite the government aid being provided in the form of job seeker and other allowances. The shutdown in Victoria, which is responsible for approximately 1/3 of the GDP, has had a significant impact that we will continue to see in coming quarters.

The likely scenario of these shutdowns around the world and disruption of supply chains and global trade will likely result in longer-term repercussions such as company failures and permanent job losses around the globe. This, in turn, will have an impact on household debt, mortgage defaults, and subsequently equity market downturn in due course.

The impending US Presidential Election in November this year requires further need for caution. President Trump has increased his rhetoric on de-coupling with China on trade. Although this is part of his political platform, it will mean greater volatility and increased hostilities. Uncertainty of the results and the potential for President to challenge the results if not in his favour will create further angst in markets.

However, there are also some green shoots. The medical world is working collaboratively on a Covid-19 vaccine. There have been some positive testing results. Despite the media and politicians putting on a very optimistic view of having a “cure-all” vaccine within a couple of months (certainly being touted by Trump given the looming election in November), the professional opinion in the medical discipline is less optimistic with a much longer time horizon for a vaccine. This global push may, at the very least, provide medication or a vaccine that may reduce the severity of Covid-19 and, hopefully, reduce the likelihood of death. This would then make it more viable for borders to be opened and travel to resume.

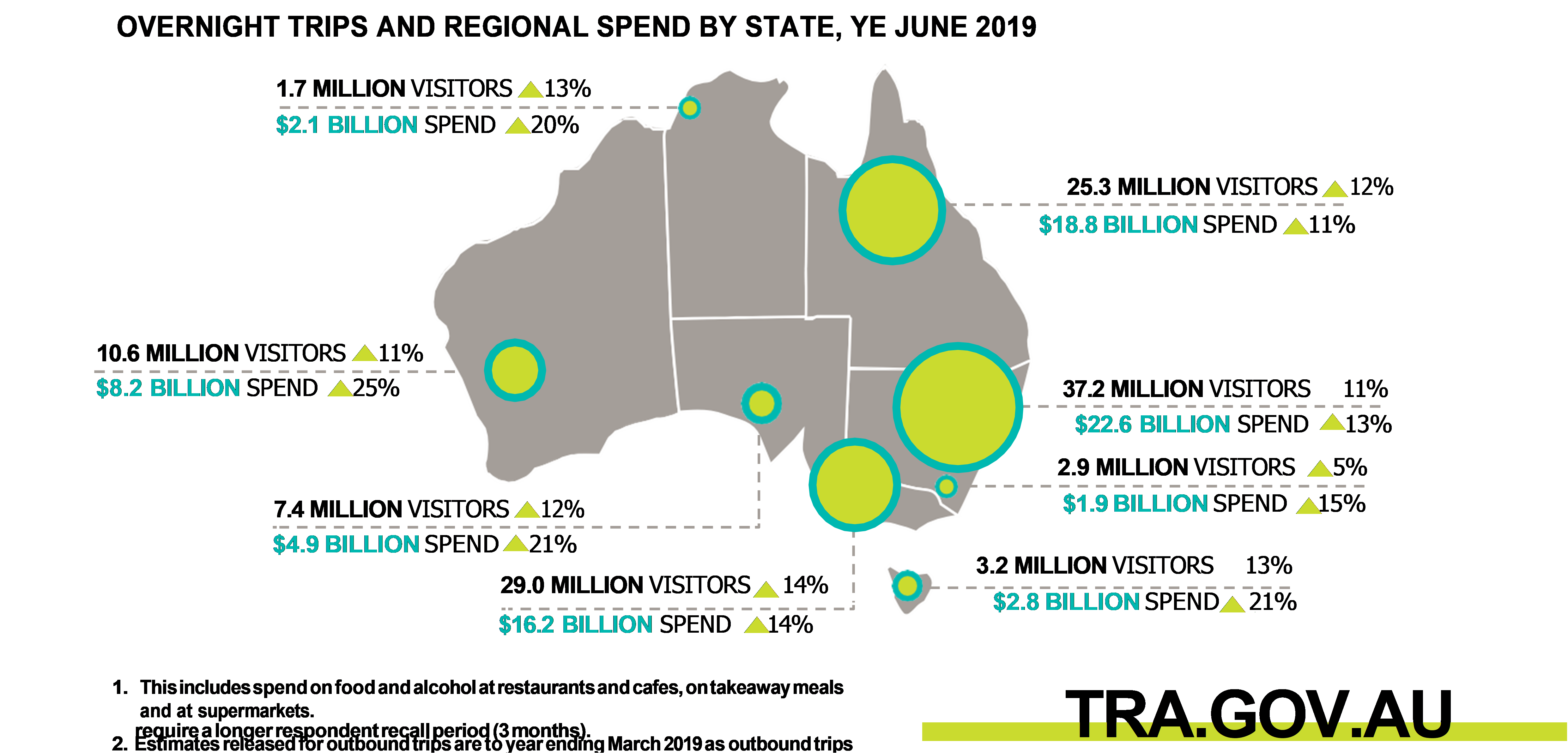

For Australia, opening the borders and, therefore increasing trade across the states would be a huge positive. Imagine all the money that we as Australians spend on overseas holidays would be spent locally. Domestic overnight travel spend within Australia by Australians last year was $77.5Billion! This would include business trips and staying overnight as well. In addition to this, Australians spent over $62Billion on overseas trips in 2019. If the overnight local spend picked up and the money spent overseas was also spent locally (as one cannot travel overseas yet), it would be a significant boon to our economy. However, for this to happen, the borders need to re-open.

Equity markets have continued to rally post the March 23rd correction. However, the question that begs consideration is whether they have overshot the mark, especially when looking at earnings per share growth decline overall. We think this warrants caution and, despite the negligible returns on cash, it would be prudent to retain a higher than normal exposure to cash to then access opportunities as they arise from market volatility. Taking a longer-term view on investments, patience is a worthwhile virtue!