This video from Andrew explains how Elixir Private Wealth can help you plan for your retirement. (video runs for 2 mins) Back to Newsletter ... Read more

September 2019 Newsletter

Since the September 2018 market correction, markets have recovered from their lows. However, geopolitical issues, such as the US and China Trade Negotiations and Brexit which caused the market correction back in September, have deteriorated further. Equity market volatility has also picked up significantly this year and continues to create stress in the market environment.

Despite historic low unemployment globally and generally still a growth tilt across most major economies (albeit at a decreasing rate), consumer spending has dropped off due to low wage growth and relatively high debt levels, not to mention concerns around geopolitical risks. Most recently, the escalating trade war between US and China has caused the US manufacturing numbers to show a marked decline and subsequently, has had a negative impact on consumer sentiment. Despite President Trump’s rhetoric that the trade war will hurt China far more than the US, the impact is certainly now evident in the US.

Incidentally, the Australian property market, especially in Sydney and Melbourne, has started to pick up again given low interest rates and APRA relaxing the lending covenants of the banks. This, in turn, will improve consumer sentiment in Australia and hopefully lead to spending. This has provided the RBA some reprieve in not having to lower the interest rate any further at this stage, although it is poised to do so if the economy requires it. However, a prolonged trade dispute will certainly weaken global GDP and trade and will impact Australia’s enviable trade surplus by dampening commodity prices and export of our resources. In other words, a recession scenario becomes more likely.

The impact of tariffs themselves on the global economy is manageable. Actions by the Chinese Government and PBOC to stimulate their economy should work, and there are some signs of stabilisation. Should the US and global economy unexpectedly deteriorate further, the Fed and other central banks stand ready to ease. We continue to believe that President Trump will want to de-escalate the trade war as the 2020 election nears. Especially given that the impact is now clearly showing in US manufacturing and consumer sentiment.

What would a slowdown in China mean for the rest of the world?

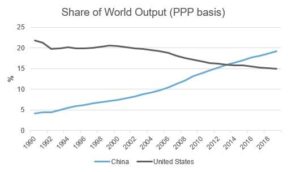

All things considered, the notion of the global economy catching a cold from China sneezing is probably a bit overblown at the moment. By one estimate, a one per cent GDP shock in China reduces global growth by 0.22%. By comparison, it has been estimated that a one percent change in US GDP growth would impact other advanced economies by 0.8 percent. This is likely to eventually change as China’s transition to a more consumption-based economy continues in coming years. An unhealthy Chinese economy will likely command the attention of global policymakers to a much greater extent within the next decade.

Chart: Origin of China’s imports (please click on chart to view)

Chart: Origin of China’s imports (please click on chart to view)

We have erred on the side of caution over the past 6 or more months. It is best to remain invested with a tilt towards defensive allocation. The risks remain elevated on both the downside and the upside. If the trade war escalates causing further deterioration economically, than equity markets will correct. However, if President Trump does finally do a deal with China, markets will be jubilant and increase.

Fundamentally, investing with quality in mind, any temporary downturns are just that --- temporary. The direction is unpredictable and the course of action is to remain true to our long-term asset allocation strategy with a tilt towards the defensive to weather the storm and provide some downside protection. We will continue to monitor markets and keep our ear to the ground with regards to geopolitical developments to ensure we are geared to manage any risks that this may present.

Warmest Regards

Aziz Meherali

Credit report changes: don’t be caught out

If you applied for a home loan in the current financial environment , your lender would probably assess your application in the context of both your credit score and your credit history – on top of your income, assets, liabilities and living expenses. Your credit score is a number calculated by a ... Read more

10 spring veggies anyone can grow

In spring, by the end of the day, you should smell like dirt. For me, gardening rejuvenates every part of my mind and body. Sinking my hands in the soil focuses my mind back to the present moment. Pulling a few weeds helps me let go frustrations and, in the process, turns them into compost to ... Read more