Periods of market volatility are an inevitable part of investing. Whether driven by economic data, geopolitical events, or shifts in investor sentiment, fluctuations in share markets can be unsettling—even for experienced investors. During these times, it is natural to question whether stepping out of the market might provide a sense of security. However, history consistently shows that maintaining a disciplined, long-term investment approach is often the most effective path to achieving financial goals.

Volatility Is Normal, and Usually Temporary

Markets do not rise in a straight line. Short-term declines, corrections and even bear markets are part of a normal investment cycle. While headlines tend to amplify uncertainty, long-term market data demonstrates that periods of volatility have historically been followed by recovery and growth. Investors who remain patient are typically rewarded as markets stabilise and return to their upward trend.

Missing the Best Days Can Impact Long-Term Returns

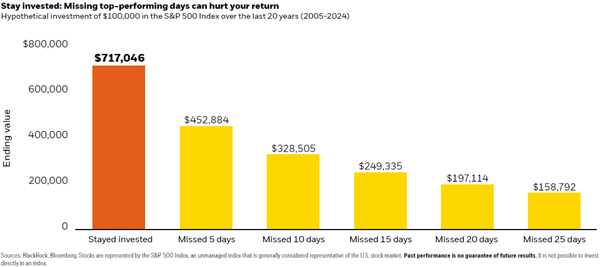

One of the strongest arguments for staying invested is the impact of missing just a handful of the market’s best-performing days. These often occur unexpectedly—sometimes directly after periods of steep declines. Attempting to time the market by exiting during downturns and re-entering later can significantly erode long-term returns, as it increases the likelihood of missing these crucial rebound days. The graph below highlights how a hypothetical $100,000 investment in stocks would have been affected by the missing the market’s top-performing days over the 20-year period from 1 January 2005, to 31 December 2024. In the example, an individual remaining invested for the entire period would have accumulated $717,046, while an investor who missed just five of the top-performing days during that period would have accumulated only $452,884. Note: all amounts are in USD.

Compounding Works Best When uninterrupted

Compounding—the process of earning returns on prior returns—is one of the most powerful forces in investing. Its effectiveness relies on time in the market, not timing the market. Interruptions to your investment strategy, especially during turbulent periods, can slow or reduce the long-term compounding effect that drives wealth creation.

A Diversified Strategy Helps Manage Uncertainty

Staying invested does not mean ignoring risk. A well-constructed, diversified portfolio is designed to weather market cycles and reduce the impact of volatility. Diversification across asset classes, sectors, and geographies helps smooth returns over time and reduces reliance on any single investment performing well.

A Long-Term Plan Reduces Emotional Decision-Making

Volatility can trigger emotional responses that lead to reactive, short-term decisions—often at the worst possible moments. A clear, personalised investment strategy provides a framework for navigating uncertainty with discipline. Staying focused on long-term goals, rather than short-term market movements, helps ensure that investment decisions remain aligned with your broader financial objectives.

Professional Guidance Provides Perspective and Stability

Working with a financial adviser can provide reassurance and clarity during volatile periods. Regular reviews, objective advice, and a long-term perspective help investors remain focused on their strategy, adjust portfolios where appropriate, and avoid decisions based solely on short-term market noise.

Final Thoughts

Market volatility is uncomfortable, but it is also a natural and expected part of investing. However, it is important to remember that volatility is temporary, growth is long-term. Investors who remain disciplined and stay invested, even during market corrections, historically achieve better outcomes than those who try to time the market. Staying invested—supported by a diversified strategy and a clear financial plan—remains one of the most effective ways to achieve long-term goals. By maintaining discipline and focusing on the bigger picture, investors are better positioned to capture future opportunities and benefit from the long-term growth potential of markets.