Markets have produced yet another year of stellar returns despite the uncertainties around tariff negotiations, Gaza, and the Ukraine. The trade uncertainties have somewhat subsided from the height of the concerns during the month of April when markets corrected substantially before posting a quick and sharp recovery. However, there is still ambiguity of tariff levies on items such as semiconductors and pharmaceuticals which could potentially disrupt markets. This is further exacerbated by Trump trying to gain control or at least yield some sway with the Federal Reserve by placing his supporters on the board and this makes markets further uncomfortable with the potential loss of independence of the Fed. Therefore, a concerted and cautious approach is warranted in managing portfolios.

Markets have produced yet another year of stellar returns despite the uncertainties around tariff negotiations, Gaza, and the Ukraine. The trade uncertainties have somewhat subsided from the height of the concerns during the month of April when markets corrected substantially before posting a quick and sharp recovery. However, there is still ambiguity of tariff levies on items such as semiconductors and pharmaceuticals which could potentially disrupt markets. This is further exacerbated by Trump trying to gain control or at least yield some sway with the Federal Reserve by placing his supporters on the board and this makes markets further uncomfortable with the potential loss of independence of the Fed. Therefore, a concerted and cautious approach is warranted in managing portfolios.

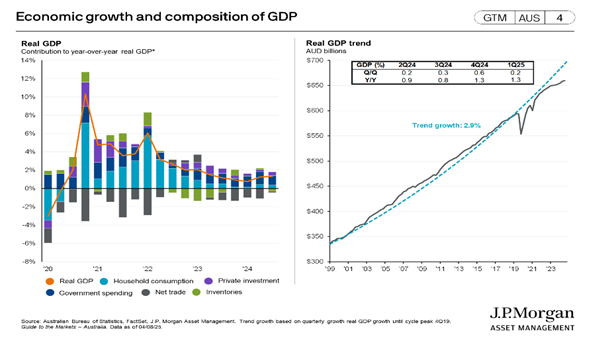

Despite what is an uncertain environment, US corporate earnings have proven to be resilient with close to 80% of them exceeding expectations and earnings have increased by 8.5%, again above estimates. In Australia, both business conditions and consumer sentiment improved, and our equity markets are now on par with the US after trailing them for the past several years. Equity market valuations are now somewhat stretched on historical valuation metrics. However, employment remains strong globally; consumer sector has had strong discretionary spending growth; consumer balance sheets are strong; house prices have seen growth further improving confidence; GDP numbers just out this week have surprised on the upside; and AI driven enhancements are a tail wind for acceleration in future growth.

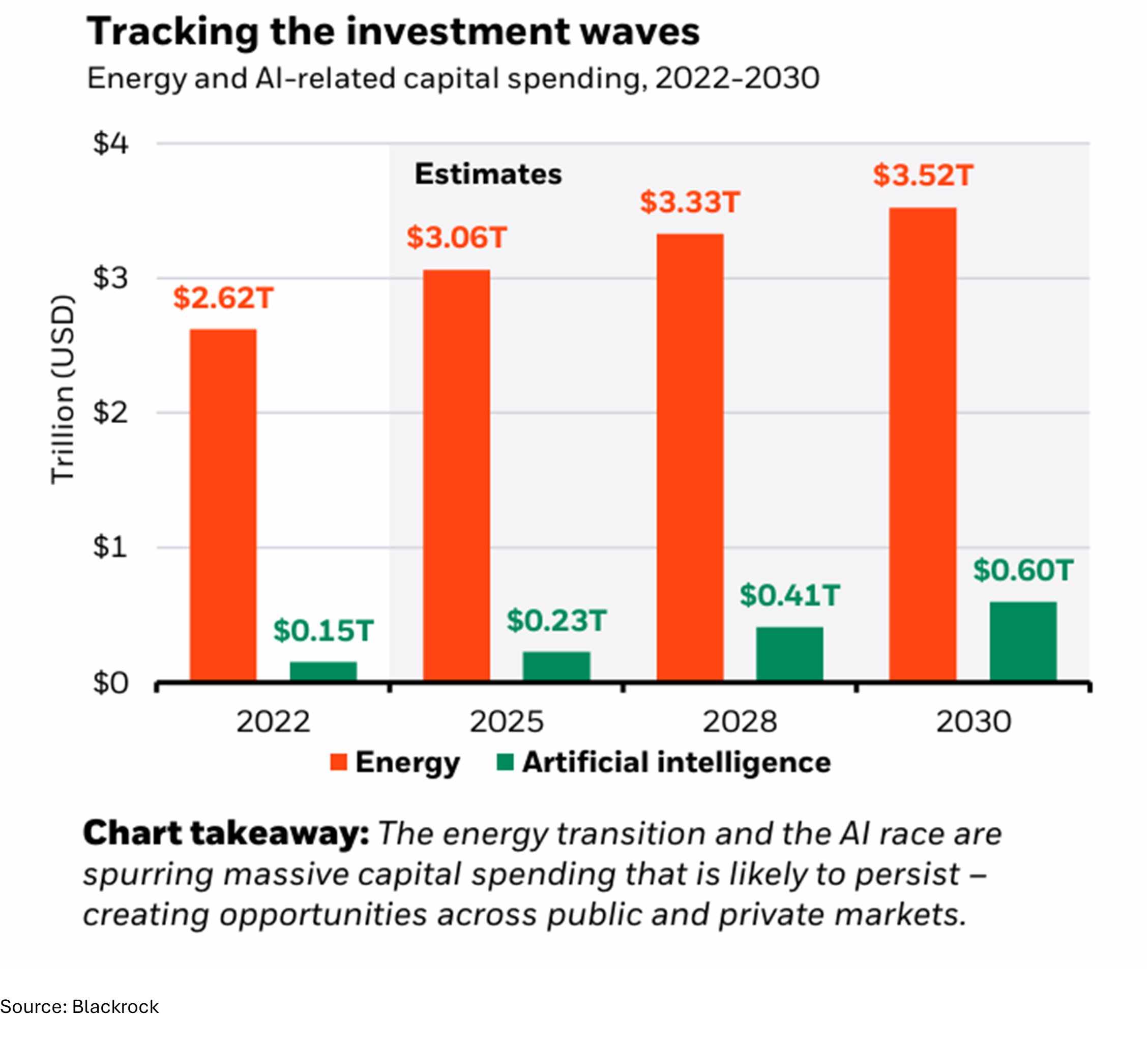

Capital spending and building the infrastructure of the future is still boosting spending and Private markets are playing a growing and crucial role in funding this growth. Governments are focussing capital on ensuring energy security and tighter controls on critical tech. The ‘cold war’ is now about tech and AI advancements.

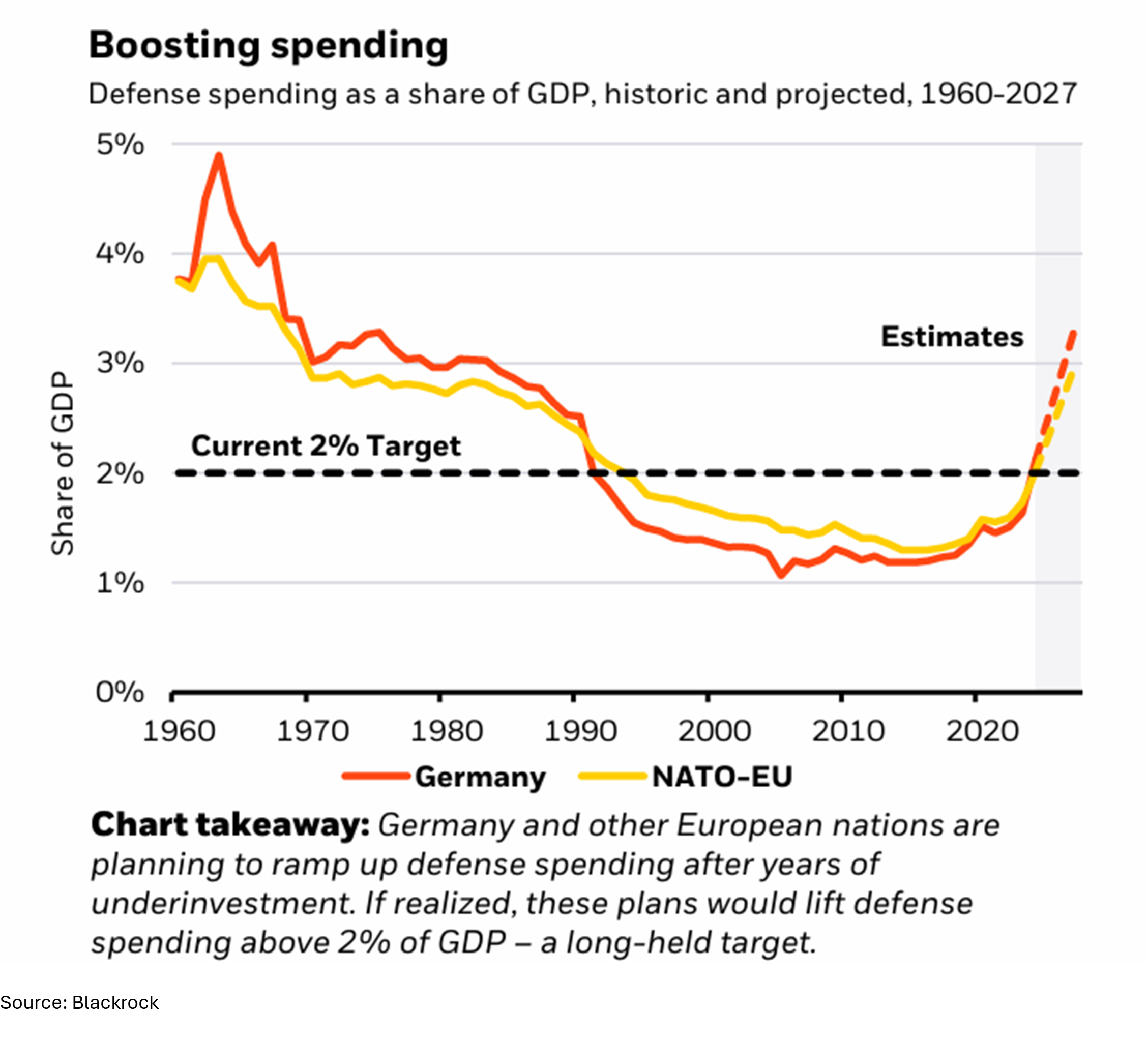

This growth in tech will be further fuelled by demand from the US that NATO countries, and Australia, spend more on defence rather than relying on the US as a ‘saviour’. This will result in further enhancements in technology across the globe and development of defence capabilities is enhanced by a boost to defence spending as part of most countries’ GDP. With a curb on immigration into the US, strained relationship with India and China, it is very likely that the talent that once helped the US become a tech leader over the past decade is likely going to find a new home in Europe, Australia, etc. This will create further opportunities in emerging markets and Europe we believe.

However, one cannot completely discount the US. The US stock markets have outperformed for the past decade driven by tech innovation, robust corporate earnings, and economic resilience. As per the latest corporate earnings season, the US corporate is still strong and continuing to improve. European equities have started to perform and have done well for the first half of this year. They continue to offer upside due to fiscal support in defence, aerospace, etc., as stated and shown in the chart above. However, US exceptionalism is still strong, and it would be a mistake to discount that just yet. However, stock selection is now more important than ever and a concerted effort in picking specific stocks and industries and increasing exposure to certain regions of the world is now warranted. This all points towards a more active approach to portfolio management and construction in our view.

We believe in employing deep and extensive research capabilities of Global Leaders such as Blackrock, Vanguard, and JP Morgan in constructing our portfolio to ensure they stand the test of time and can weather market forces and volatility at both the worst of and best of times. There is further due diligence at our licensee level where funds are required to have gone through a research house, such as Lonsec, for an approved rating in addition to regression analysis by competitors and like-for-like funds as well as scrutiny by our Investment Committee. This process, along with our quarterly face-to-face meetings with our portfolio managers ensures a robust portfolio that achieves our clients’ longer-term goals and objectives.

Lastly, as always, I leave you with the following quotes to ponder.

“An investment in knowledge pays the best interest” —Benjamin franklin

“Successful investing is about managing risk, not avoiding it.” —Ben Bernanke