How quickly the year is going by with end of the financial year upon us in three weeks!

How quickly the year is going by with end of the financial year upon us in three weeks!

Markets started well in 2024 and then waned in April to then pick up again in May. However, volatility of markets has picked up again and market gyrations have become a norm post the straight line run up early in the year.

Markets continue to move based on inflation readings and conjecture on central bank’s move on interest rate reduction.

US equity markets responded positively to a more subdued April inflation print, which took the possibility of further rate hikes off the table.

US government bonds rallied 18bps, showcasing the biggest monthly decline in yields since December 2023, according to CommSec, which created the positive backdrop for an equities rally.

The Dow topped 40,000, its best performance since 2020, and Apple rallied 13% over May on the back of better-than-expected quarterly earnings, plus a record-breaking US$110bn stock buyback.

The S&P500 lifted 4.8% in May with NASDAQ up 6.9% with both indices registering their best May performances since 2003.

The US market, whilst still resilient both economically and at a company level, is now quite stretched. The consumer and smaller corporates are slowing down, and consumption is starting to mellow. Whilst we remain positive on equity markets in the US in the short term, we think being far more discerning around stock selection is now necessary to avoid pitfalls.

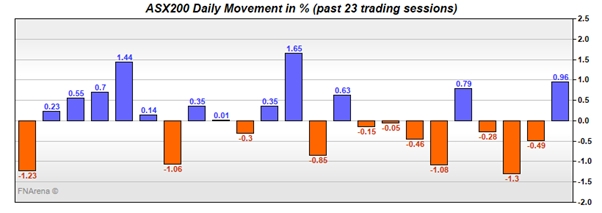

The Australian market, according to Morgan Stanley, has experienced heightened volatility with no less than 6 +/- 1% daily moves for the ASX200 post the April CPI print as shown in the chart below:

The Consumer Discretionary, Real Estate, and Communication Services sectors fell the most in response to higher-than-expected inflation in April — a reading of 3.6% versus expectations of 3.4%.

Banks rose as did technology stocks (Xero, TechnologyOne, etc.) based on good performances. Utilities also rose based on the assumption of higher demand for power for data centers based on the AI narrative. Financials, however, were the standout performer in terms of contribution to the ASX200.

Much like the US, but to a lesser extent, Australian equity markets also remain elevated based on longer-term average. Current PE (price to earnings) ratio stands at about 16.3x versus the historical average of 15.8x. However, same as the US markets, there are pockets of opportunities especially in the mid to small cap space which has not had as much of a run up.

Our GDP number also came out yesterday at 0.1% growth for the quarter and it was below the 0.2% expected. GDP per capita fell for the fifth consecutive quarter, falling 0.4 per cent in March and 1.3 per cent through the year. This is further evidence of a slowing economy and throws caution to the wind when looking at investment markets.

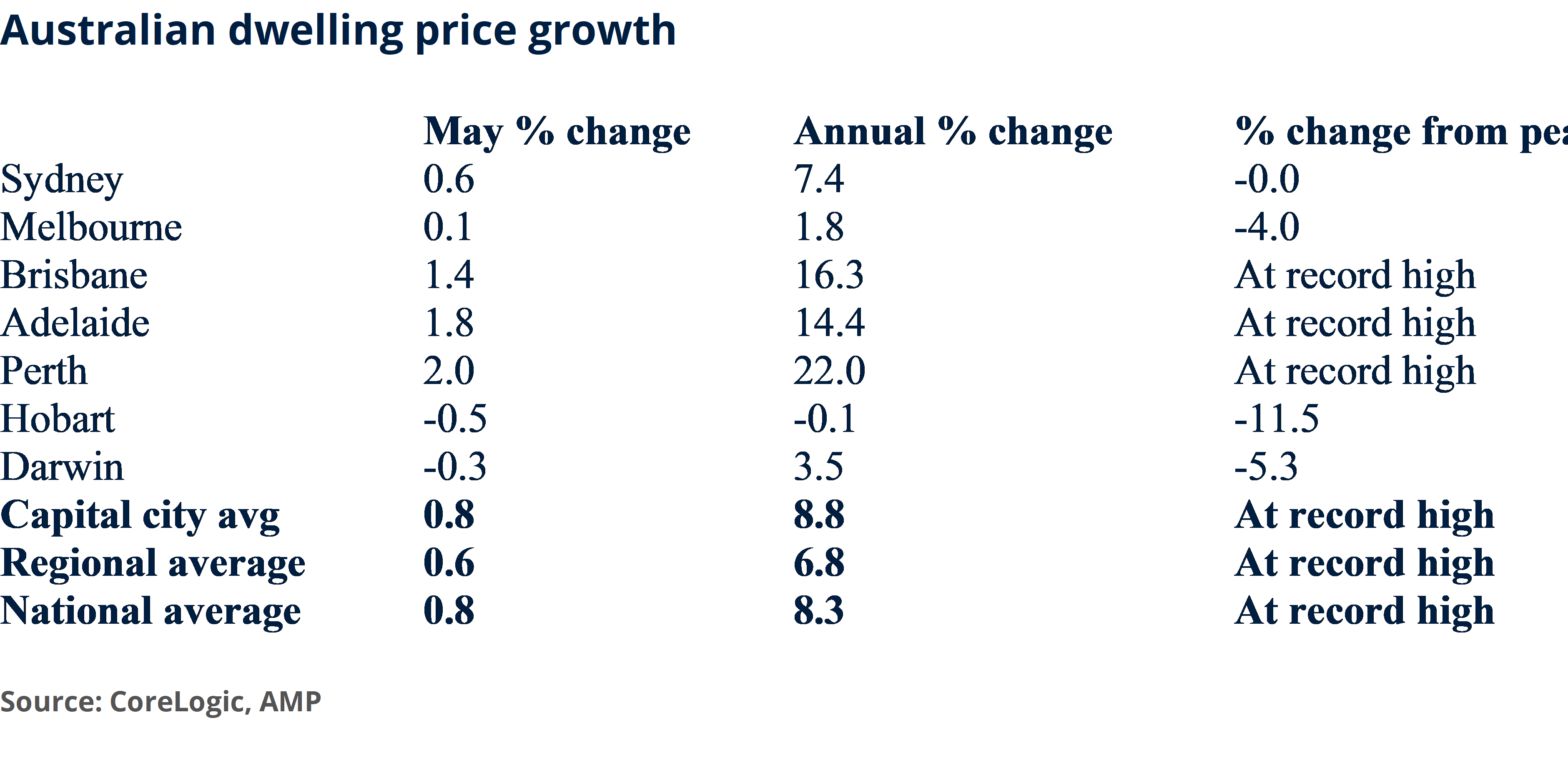

Let’s turn to everyone’s favorite topic in Australia, Property! On average, property had an 8% gain last year and expected to rise again this year around the 5% mark. However, what is interesting is the Median house price growth in some regions. See the table below:

Surge in prices in Brisbane, Adelaide, and Perth is likely to worsen their attractiveness, eventually leading to slower price growth in those cities.

There continues to be extreme shortage due to population growth (driven by immigration levels). The population grew by a record 660,000 over the year to September quarter requiring an additional 250,000 homes against a completion of about 170,000 homes. The building industry is also struggling with rising costs of material and labour, along with labour shortages. This shortage in supply and growth in demand has also contributed to rising prices despite the higher cost of borrowing due to higher interest rates. A rise in unemployment is likely to add to downside risks to property prices if higher interest rates prevail.

Whilst we have enjoyed growth in our asset base due to rising property prices as well as portfolio valuations over the past 2 years, economies and markets are slowing down. We also have elections in most developed countries coming up which can add to further volatility and potential for surprises resulting in market mayhem.

Incredibly, the wars raging in Europe and the Middle East seem to be taken in stride by equity markets. Short of a significant escalation, they are not moving the dial anymore.

We have, being conservative by nature, now positioned our portfolios to more closely align with the longer-term benchmarks. This has meant a small reduction in equities (largely top-end US) and an increase in small and mid-cap exposures as well as in Emerging Markets. This has also resulted in an increased allocation to defensives to ensure our portfolios weather the market volatility with a reduction in risk.

We will continue to monitor markets and movements with the view to accessing available opportunities whilst reducing market risk where possible. However, remember that time in the market and not timing the market leads to good longer-term results.

I now leave you with some thoughts to ponder: