We had anticipated a volatile 2023 and we have not been disappointed! Stubbornly high inflation and rising interest rates have led to market uncertainty and hence the volatility.

We had anticipated a volatile 2023 and we have not been disappointed! Stubbornly high inflation and rising interest rates have led to market uncertainty and hence the volatility.

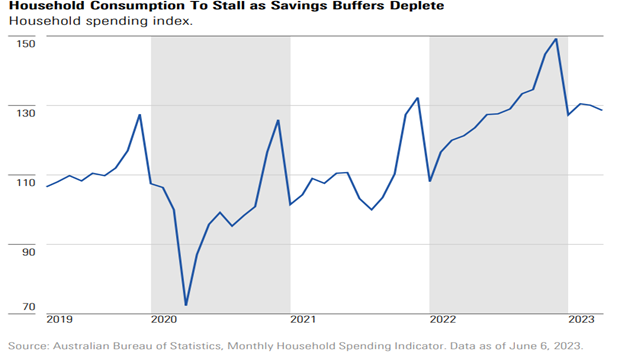

The global economy has already started to moderate and J.P. Morgan research expects the U.S. to enter a mild recession towards the end of this year. Although, based on the most recent company reporting season that ended a week or so ago, companies are still in good shape albeit forecasting a reduction in future earnings as was widely expected due to cost of living pressures and high interest rates expected to reduce disposable income for most households.

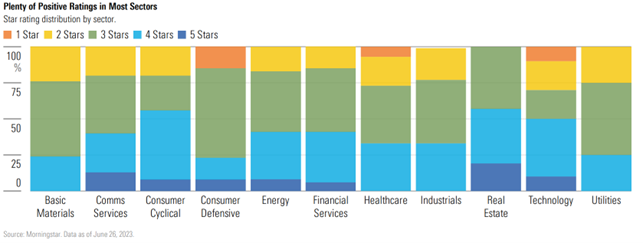

Economic data out of China recently has been disappointing and the stimulus from the reopening of their economy has been softer than expected. China is focussing on a transition from a capital intensive, investment driven economy to a service driven economy much like the Western world. Whilst mining stocks have pulled back, they are likely to remain under pressure as China moderates its building activities. However, there are still opportunities in other sectors in Australian equities as can be seen in the chart below which illustrates the rating distribution from Morningstar on the various sectors of the Australian economy.

The fall in house prices in Australia seems to be over and major capital cities like Sydney and Melbourne posting growth in recent months. The housing shortage and increased immigration post covid are what seems to be offsetting factors in the housing decline momentum. Inflation still does remain a concern but has been falling as of the last read a couple of weeks ago, providing some comfort and resulting in a positive reaction in equity markets.

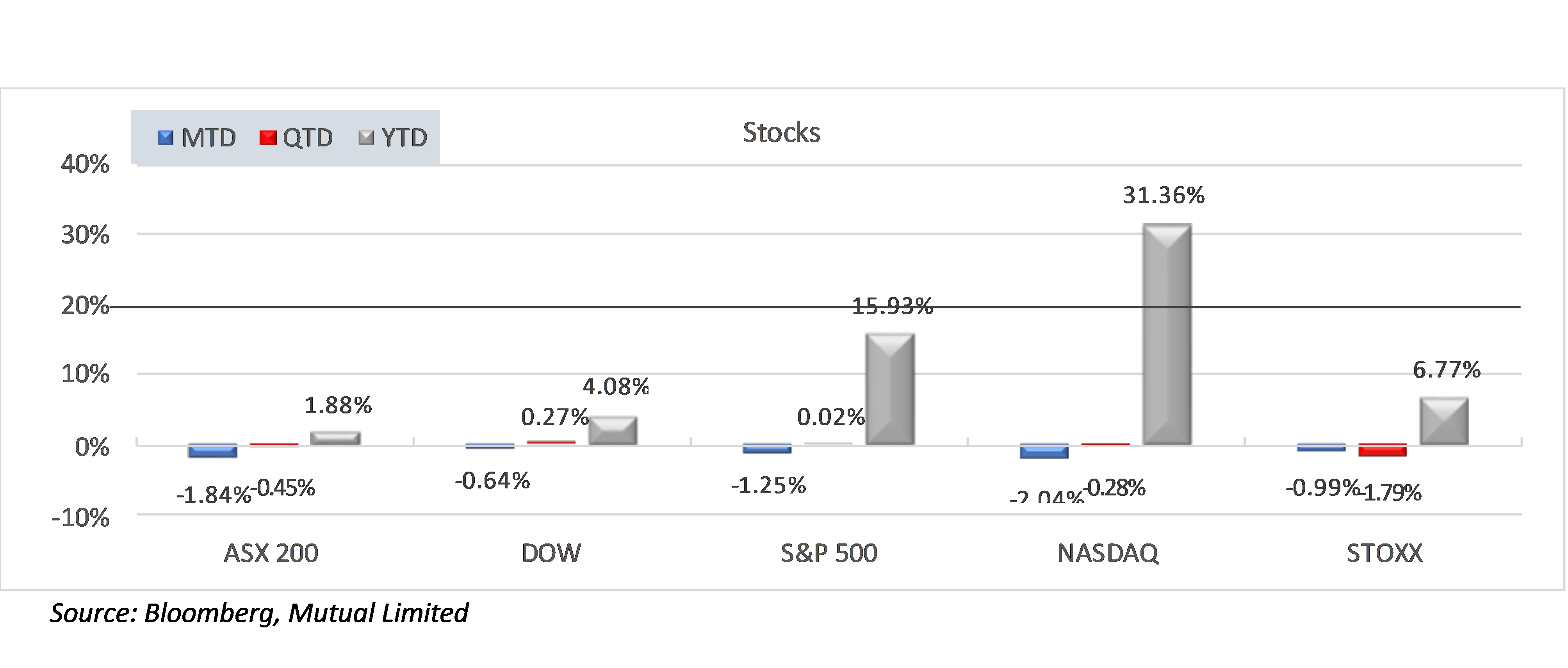

Equity markets have posted a decent recovery towards the latter half of this year after an extremely poor performance in 2022. However, most of those returns have been concentrated primarily in technology and tech-related shares.

Macro issues (such as interest rates, inflation, and a looming recession) are taking centre stage in equity market volatility whilst stock fundamentals are taking a back seat to performance. This, in our view, should start to reverse trend once the interest-rate hiking cycle is at its end. This is largely expected to be in November with a further 0.25% interest rate hike in the US. The Reserve Bank in Australia has held off on rate hikes for the past three meetings but is still throwing caution to the wind with no indication that this hiking cycle is over.

We see greater dispersion in earnings estimates based on an economic slowdown. Cyclicals and those more dependent on disposable income are likely to come under pressure and those with stronger balance sheets and a higher market share will likely hold up better. This suggests greater opportunity for skilled fund managers to generate excess returns and the concepts of diversification and a greater emphasis on stock selection will become paramount in generating positive returns.

We have benefited greatly over the past 12 months from our selective approach to portfolio construction and fund selection and will continue to remain focussed on keeping our ears to the ground and our eyes peeled on market risk as well as potential opportunities in managing our portfolios.

As always, here are a few quotes as food for thought:

“ You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” — Peter Lynch

“ With a good perspective on history, we can have a better understanding of the past and the present, and thus a clear vision of the future.” — Carlos Slim Helu

— investors often lose perspective, panic, and sell. Looking at history, markets recovered from the 2008 Financial crisis, and even the Great Depression!