As largely expected, 2023 has seen market volatility and uncertainty reign high despite company reporting still being robust and performing above market expectations for the most part. The market rally, in particular over the past 3 or so months, has been largely concentrated in the Big End of town and has not been broad based. This, to us, means that this is not a sustained rally, and we expect momentary pull backs still to occur before we start to see any market stability coming through.

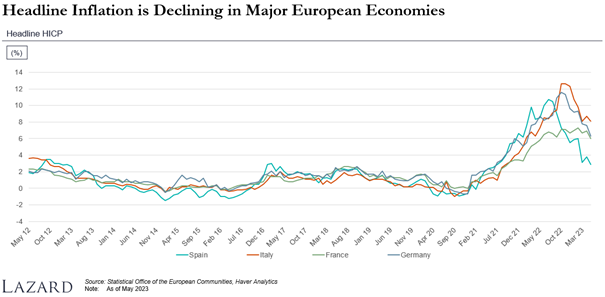

As the chart below highlights, inflation has been declining and is now largely off the peak. At the peak, inflation was over 12% — a far cry from the mantra of achieving 2% to 3% inflation targets by Reserve Banks around the Globe! This was largely fuelled by the huge stimulus around the Globe to fight the covid correction as well as the energy crisis due to Russia’s invasion of the Ukraine. Hence the persistence of the Reserve Banks around the Globe in raising rates incessantly.

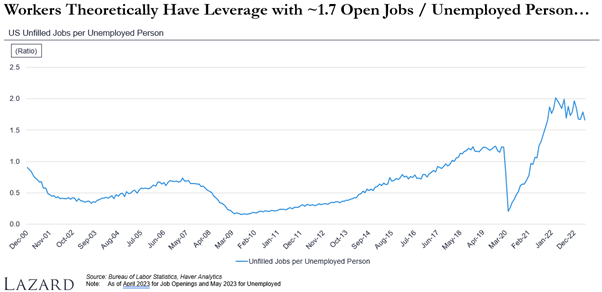

However, Core Inflation, which measures cost of goods and services (excludes food and energy), has been persistently high. For example, and as per the table below, the US labour market is still very tight with about 1.7 jobs per unemployed person. This means workers have leverage and this is causing ‘wage inflation’ to remain high and causing stress for the Federal Reserve. Australia is in a similar situation and, the hike in rates this week on Tuesday by 0.25%, was partially blamed on the increase to the minimum wage of 5.75%. Argument for this wage increase was touted to be due to the cost-of-living increases. However, this becomes a catch 22 as labour costs cause increase in cost of production which then gets passed onto the end consumer. This then fuels inflation which leaves the Reserve Bank with no choice but to raise rates causing other issues such as mortgage stress and potentially causing a recession. Off course, there are other factors in this mix but the above is just a simple illustration of the issues at hand.

Luckily, the US Debt Ceiling issue was resolved recently. This would have been potentially catastrophic at a time when markets are already nervous and lacking direction and certainty. Chinese PMI (Purchasing Managers’ Index — shows the prevailing strength in the manufacturing and services sector) was somewhat weaker than expected. However, China does not have inflationary issues and can, if required, stimulate their economy. Their re-opening post the covid lockdowns will lead to a resurgence in trade over time. This coupled with the pent-up demand for goods as well as savings accumulated during the lockdowns should provide a boost to global economies, albeit this could lead to some inflationary pressures as well.

Australia, from an economic perspective, has remained relatively well positioned as a commodity producer given the energy crisis in Europe and other parts of the world. We too have enjoyed a very tight labour market, meaning spending power has remained strong. However, inflationary pressures leading to the interest rate hiking cycle will now start to take a bite as a large percentage of fixed rate mortgages reprice this month and the next. Base case now is for a mild recession in Australia. Mind you, markets have priced in a mild recession in the US for months now and this is likely to come to fruition as well.

From a market perspective, common sense is now starting to return. What I mean by this is, for the past several months, good news was seen as bad news from an inflationary perspective and fear of further rate hikes caused a market downturn. Similarly, bad news from a company reporting perspective, was seen as good news as this meant the Reserve Bank would not raise rates and markets were appeased. This is now starting to go the other way with good news being taken as a good thing by markets and vice versa.

As mentioned at the beginning of this write-up, the market rally over the past few months has been quite concentrated and not broad-based across markets. This too seems to have turned the corner over the past few days with a broader-based rally, including in the small caps space. Once the hiking cycle is at its end sometime in the next couple of months, markets should settle as the uncertainty that has driven market sentiment over the past 18 or so months will have dissipated. Focus will then return to fundamentals and common sense. Assuming no ‘X-factor’ event, we believe markets will start to stabilize and benefit most markets and indices, and reward companies that perform well and have good prospects going forward. This will then reward the investor who takes a longer-term view, adheres to fundamentals, and doesn’t chase performance.

As always, I leave you with some quotes to ponder.

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

“Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off.” — Carlos Slim Helu

The individual investor should act consistently as an investor and not as a speculator.” — Ben Graham