Reality and theory often do not go in tandem with how markets react. This has been our experience since the beginning of 2022, and markets have continued to remain erratic for the duration of this year so far.

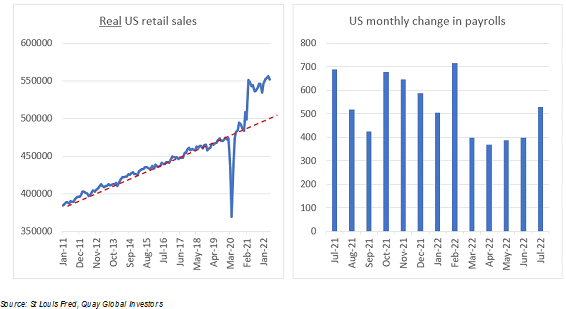

Recent data across the US shows jobs and retail sales are still quite robust and Australia has also continued to enjoy record low unemployment and strong retail sales. Recent company reporting on profit results was also above expectation.

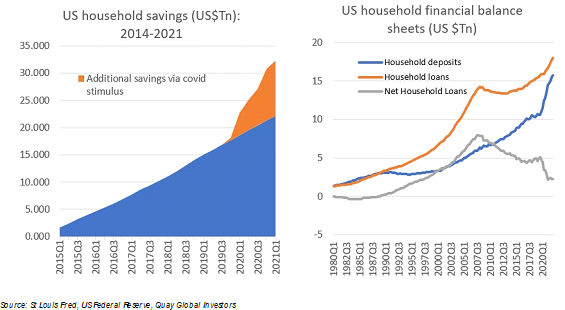

Due to covid restrictions on travel (and movement if you were in Australia during the covid peak), and covid stimulus paid out by various governments around the globe, household savings have increased significantly. Couple this with a significant increase in housing prices, and a very tight labour market causing wage increases, household balance sheets are in very healthy shape and, so far, have been able to withstand the increase in interest rates.

Increasing interest rate environment will eventually start to ‘bite’ into household savings leading to a slowdown in demand for goods and services globally. This is what the Central Banks globally are counting on to curb inflation. The uncertainty around the number of rate hikes and the severity of these are what is driving significant volatility in equity markets. This is due to the fear that a slowdown in demand will cause a recession in the US and globally.

Increasing interest rate environment will eventually start to ‘bite’ into household savings leading to a slowdown in demand for goods and services globally. This is what the Central Banks globally are counting on to curb inflation. The uncertainty around the number of rate hikes and the severity of these are what is driving significant volatility in equity markets. This is due to the fear that a slowdown in demand will cause a recession in the US and globally.

We believe the inherent volatility this uncertainty creates will continue at least until the end of this calendar year and likely beyond to the first half of 2023.

Commodity and oil prices have eased in the past few weeks, and this is a positive in getting inflation under control in due course. However, this also reduces profit for our commodity producers in Australia. Our treasurer in Australia, Jim Charmers, has commented on that fact that the budget cannot afford a further stimulus package as this results in higher inflation, not to mention funding issues in slowing economic conditions. This leads us to believe that the October budget will have a restrained spending policy in Australia.

Given this backdrop around the globe, shares remain vulnerable in the short term. Shares hit lows in June (-24% for US Shares and -16% for Australian Shares). Global and US shares have already entered a bear market (as defined by a 20% or more fall from top to bottom). Whilst these have had a recovery last month, we have seen them fall back again so far this month.

Whilst we are positive over a 12-month horizon, we believe there may be more downside (and temporary) risks in equity markets as demand slows post further rate hikes. Off course, this is further exacerbated given the geopolitical risks around Taiwan and Ukraine. However, much like the market gyrations we have experienced in the past 6 months, markets will continue to present opportunities when taking a longer-term view to investing.

Remember, our underlying holdings across our portfolio of managers is fundamentally sound and will recover once markets stabilize. One only has to go back to the March 2020 covid correction when markets capitulated down 37% within a few days. Our portfolios not only recovered (post a fall of around 16% on average compared to market) but hit a peak in December 2021 post these falls. Therefore, we need to remain steadfast in our approach to investing and take a long-term view and ignore the ‘noise’ that markets create on a day-to-day basis.

“Worrying is like a Rocking Chair, it gives you something to do but gets you nowhere” —Glenn Turner

We wish you all Good Health and Success in all your endeavours.