Rising inflation, the conflict in Ukraine, prolonged supply chain issues, pandemic-related lockdowns in China and monetary policy tightening by central banks have weighed on financial markets recently, stoking concerns about a global economic slowdown. Most analysts put a US recession at 50/50 depending on the voracity of the Fed’s rates tightening cycle.

Rising inflation, the conflict in Ukraine, prolonged supply chain issues, pandemic-related lockdowns in China and monetary policy tightening by central banks have weighed on financial markets recently, stoking concerns about a global economic slowdown. Most analysts put a US recession at 50/50 depending on the voracity of the Fed’s rates tightening cycle.

Since January this year, NASDAQ is down over 27%; S&P 500 is down over 17%; All Ords is down 6.3%; US Government Bond Index is down 9.19% and Corporate Bond index is down 11.55%; and lastly the Vanguard Property Index is down 15.48%. Therefore, as you can see, no asset class has been spared from this significant downturn in markets driven largely by sentiment on interest rates, inflation, as well as geopolitical concerns around Ukraine.

Since 1926, there had been 15 recessions, 18 bull runs and 17 bear markets in the US. This includes periods in which it endured wars, a depression, and a pandemic.

In 11 of the 15 recessions, stock market returns were positive over the subsequent two years. In addition, the potential gains outweighed the losses, with equities delivering average annualised returns of 7.8% in the two years after each recession.

Market prices tend to be forward-looking. By the time economists officially declare a recession (based on recent GDP growth or similar), the market has often long-since priced this in and is generally a forward-indicator of such events.

Until last Friday, Dow had fallen for 8 consecutive weeks while the S&P 500 and Nasdaq had declined for 7 straight weeks. We have had a bit of a recovery this week. The Fed is walking a tightrope in trying to cool the economy and inflation pressures whilst balancing this with trying not to put the US economy in a recession. The US economy is still on the growth path, although moderating slightly, whilst the most recent company reporting season showed over 78% of companies reporting above expectations. Therefore, it is not all bad news.

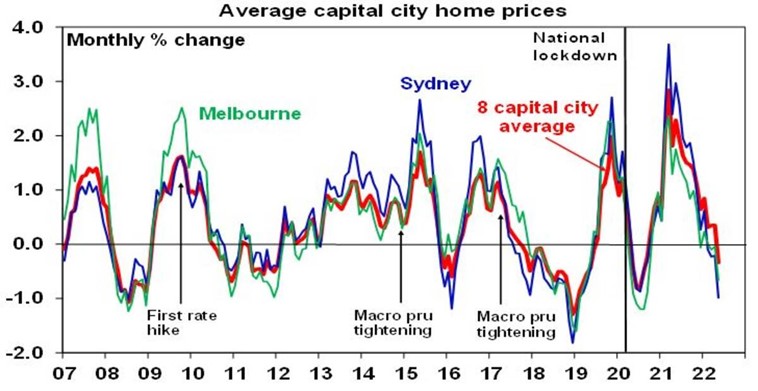

Australian residential property market has had the biggest gain over 21 months since 2003 —a whopping 29%! Whilst equity portfolios have declined in value, residential property has increased wealth significantly for homeowners. However, this cycle is turning now. House prices are starting to decline and likely to continue to do so for the remainder of this year and possibly next.

Some of the drivers of this downturn are the following:

- Affordability due to significant surge in prices since the pandemic.

- Wage growth not keeping pace with property price inflation and cost of living increases.

- Increased in mortgage rates, especially fixed rates from around 2% to 5%.

- An increase in new listings especially in Sydney and Melbourne.

- A rotation in spending on goods to services and travel as borders open up.

- A decline in consumer and home buyer confidence.

Forecasts loom of a 10% to 15% correction before stabilising.

Source: CoreLogic, AMP

The property downturn is a cyclical downturn after a 25-year bull market in capital city prices. The silver lining in this cloud is that this property price ‘cooling’ will limit how much our RBA has to hike the rates by to curb inflationary pressures on the economy.

I always like to look back at the most recent major events such as the GFC and the March 2020 Covid correction and the impact of that on our portfolios. Whilst portfolios retracted, although significantly less than markets, they all eventually recovered and soared past the previous highs. Recovery post the Covid correction was very quick (within a few months) whist the GFC was quite prolonged (a few years). Therefore, lets look at the GFC versus current state of affairs:

- Stronger Consumer: Consumer balance sheets are much stronger as lending standards have been higher and mortgages lower.

- Lower Supply and leverage: New dwellings under construction is lower and vacancy rates are also lower. The gearing levels within property trusts and generally employed by real estate investors has declined.

- Banks Stronger: Bank capital is broadly much stronger and more transparent today as complex debt and securitization structures are uncommon today based on lessons learnt from the GFC.

The risks are the low interest rates around the globe providing fewer traditional tools to central banks to fight a recession. Complexity around the Russian invasion of the Ukraine causing higher energy price and inflation. This has led to popular discontent and forced economies to become more inward looking to insulate themselves from the geopolitical risks and to shore up their own food and energy supplies. This trend is likely to increase in years to come as countries and companies lean towards less reliance on overseas countries, especially China and Russia, for raw materials and other essential supplies. This is likely to reduce globalisation and to increase cost of living going forward.

However, much like the Tech Boom/Bust, the GFC, and the Covid correction, this too will pass. It is essential that we remain steadfast to our investment principals such as diversification and investing on fundamentals not hype. We recently employed our internal research team as well as an external research house in Lonsec to review our portfolios in light of the current state of markets. We are now putting our revisions on our portfolios with our clients at each progress review juncture, to ensure we mitigate further downside risks and enhance the portfolios for a faster recovery when markets stabilize. We are confident that our existing portfolios and revisions will ensure portfolios recover and achieve their longer-term projected returns based on individual risk profiles.

As always, I leave you with the quotes below. Please feel free to contact me if you wish to discuss anything further.

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioural discipline that are likely to get you where you want to go.” —Benjamin Graham

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.” — Charlie Munger