Following on from my last write-up where I tried to share some optimism with you, our Esteemed Clients and friends, let’s recap on how things have progressed.

Following on from my last write-up where I tried to share some optimism with you, our Esteemed Clients and friends, let’s recap on how things have progressed.

Whilst Covid Delta variant is still front and centre for most of us in Australia and raising its ugly head in the US and other parts of the world who have been enjoying the return to normality, the fear factor that once engulfed the world is waning now.

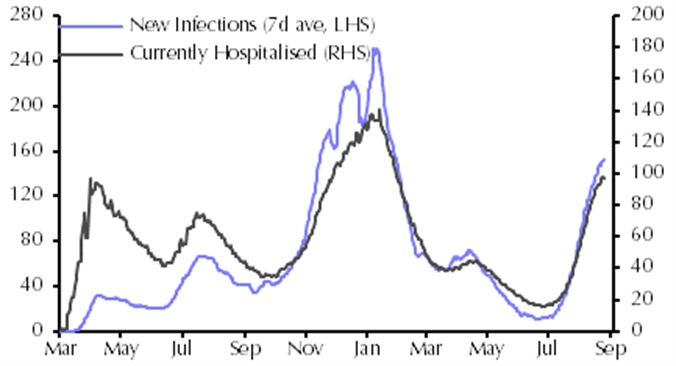

However, the rate of new infections and subsequent hospitalisations, due to the far more virulent Delta strain, are increasing. See the chart below from the US Southern States like Florida, etc. (Source: Johns Hopkins, CDC):

Recent lockdowns in Australia, China, and now in other parts of the world are hitting the economic activity and causing contraction in many industries. The continued supply chain disruptions are now causing demand to slow due to the increase in cost of goods. Inflation is still being looked at as being ‘transitory’ and, frankly, no one really knows what the end outcome for inflation will be.

Renowned economist and Professor of Economics at New York’s Stern School of Business, Nouriel Roubini, believes there is a strong likelihood of Stagflation (increasing inflation coupled with a recession) due to the ever-increasing public and private debt and the need to eventually move back to monetary policy normalisations (removal of the proverbial punch bowl). However, his belief is that this will be a medium-term issue and not imminent now.

Fresh from the Jacksons Hole Conference a week or so ago, Fed Chair Jerome Powell is sticking to the rhetoric of continued stimulus and only looking to remove this gradually as the economy evolves. This continues to give markets some breathing space. Any move that is sudden and akin to ‘hitting the brakes’, will result in a significant market pull-back and reserve bankers around the world are well aware of this predicament and seem to be taking a far more measured approach, thankfully.

Our own Reserve Bank had made the decision yesterday to keep the cash rate at 0.10% as well as continue the bond buying program at $4Billion per week. This is to ensure that the economic woes caused by Covid globally, as well as the local lockdowns most recently, do not turn into a prolonged economic downturn. Therefore, much like Central Banks around the globe, our Reserve Bank is also being supportive of an economic recovery with a loose monetary policy.

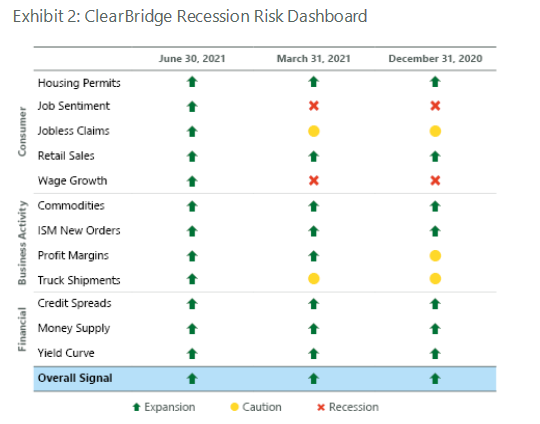

There are always two sides to a coin. There are several ‘green shoots’ that have been emerging post the covid correction back in March 2020. Manufacturing has accelerated and companies have reported a significant surge in earnings. The latest reporting season from over a week ago has resulted in over 90% of companies performing well above expectations with earnings increase in very high double digits. Wage growth has also picked up, although this is also part of the inflation concerns, as have other economic indications as illustrated by the chart below:

I recently attended the Portfolio Construction Forum (virtually off course) that was run over a couple of days. The general consensus was that economies would continue to improve over coming years, resulting in a positive trajectory for equity markets over the next 2 to 3 years. The likelihood of the stellar returns markets have enjoyed over the past 12 or so months is unlikely to continue. However, the current macro environment, as seen in the chart above, is likely to provide a positive economic backdrop albeit with lower earnings and lower positive market returns.

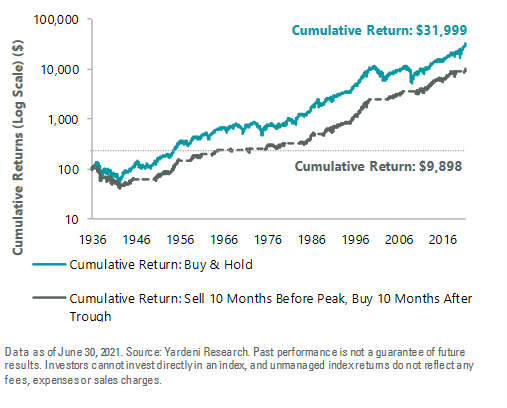

History is repetitious and the chart below illustrates this point clearly. Post major corrections, there is always upswings with intermittent pullbacks. However, what is important to note is that the trajectory is always up. The trick is to remain largely invested and to not panic and sell, and similarly, not get greedy and chase returns.

Therefore, our approach has always been to remain invested as per our agreed risk profile and strategic asset allocation whilst still making use of market intelligence in accessing opportunities with a small tactical tilt. No one, not even the best economists globally get it right. Therefore, it is best to adhere to our principles and stay focussed on our goals and reduce succumbing to the external ‘noise’ that is rarely foretelling!

“Adopt the pace of nature; her secret is patience” — Ralph Waldo Emerson