In our last newsletter back in March this year, I wrote about the prospects for markets to continue their rally upwards. My concerns were around the uncertainty of the labour market on the back of withdrawal of the job keeper government incentives package.

The uptick in employment and increase in demand (lack of travel, etc. has increased demand on consumption within the local economy) has kept the labour market tight. In fact, the Queensland government is now offering incentives to Australians to migrate for jobs to the sunny state due to significant job shortages. I spoke with some clients who were vacationing in Port Douglas, and they informed me that restaurants were opening 3 days or so per week due to staff shortages but were all completely booked as there was no shortage of visitors, albeit all Australian.

We had cautioned against inflation rises and the impact of this on equity markets tilting towards the negative. That has now started to wane, and markets seem to take solace in the fact that the Federal Reserve and Janet Yellen will do whatever is in their arsenal to keep the economy improving despite inflation lurking closer to their historic benchmark of 2%. This has resulted in markets starting to rebound again post a small dip back towards the end of March.

We had discussed the Australia/China trade spat and impact on our exports. A stronger than expected demand recovery, coupled with unprecedented levels of fiscal and monetary policy support, and tight supply due to covid disruptions has driven one of the sharpest commodity price rebounds on record. However, recent comments by Chinese policy makers have attempted to cool price growth in some commodity markets – particularly in iron ore.

The relationship looks set for further deterioration and it is good to see the Australian government looking towards other markets to replicate the demand from China. Although this will take some time, economic pain from further deterioration will need to be borne by us all in the interim which could be several years. What is also interesting is that this phenomenon is not localised to Australia but also experienced by our allies in Europe as well as the US. It would be Great to see a trading block between Australia, New Zealand, US, Europe, Canada, India, Africa, as well as Southeast Asia to circumvent the loss in both imports and exports from these countries and trade replicated between them all. This would be an enormous trading block and one, I believe, which can replace all loss in trade from China in due course. China, over the years, has gradually ingrained itself in countries such as Africa, Pakistan, parts of Southeast Asia as the lender of last resort. Pulling away from China for those countries would wreak economic havoc. I am not sure the political might and will exists amongst the leaders of all these countries to make this happen.

On a better note, Australia is now catching up in the covid vaccination space when compared to the US, UK, and Europe. Despite the complacency (you could argue it was due to the lack of urgency in our country due to insignificant number of cases), our covid numbers have remained low and, given the resurgence in Victoria most recently, has provided a sense of urgency to our population in getting the vaccination done. This has seen a marked increase in number of people getting vaccinated and helped by state vaccination centres.

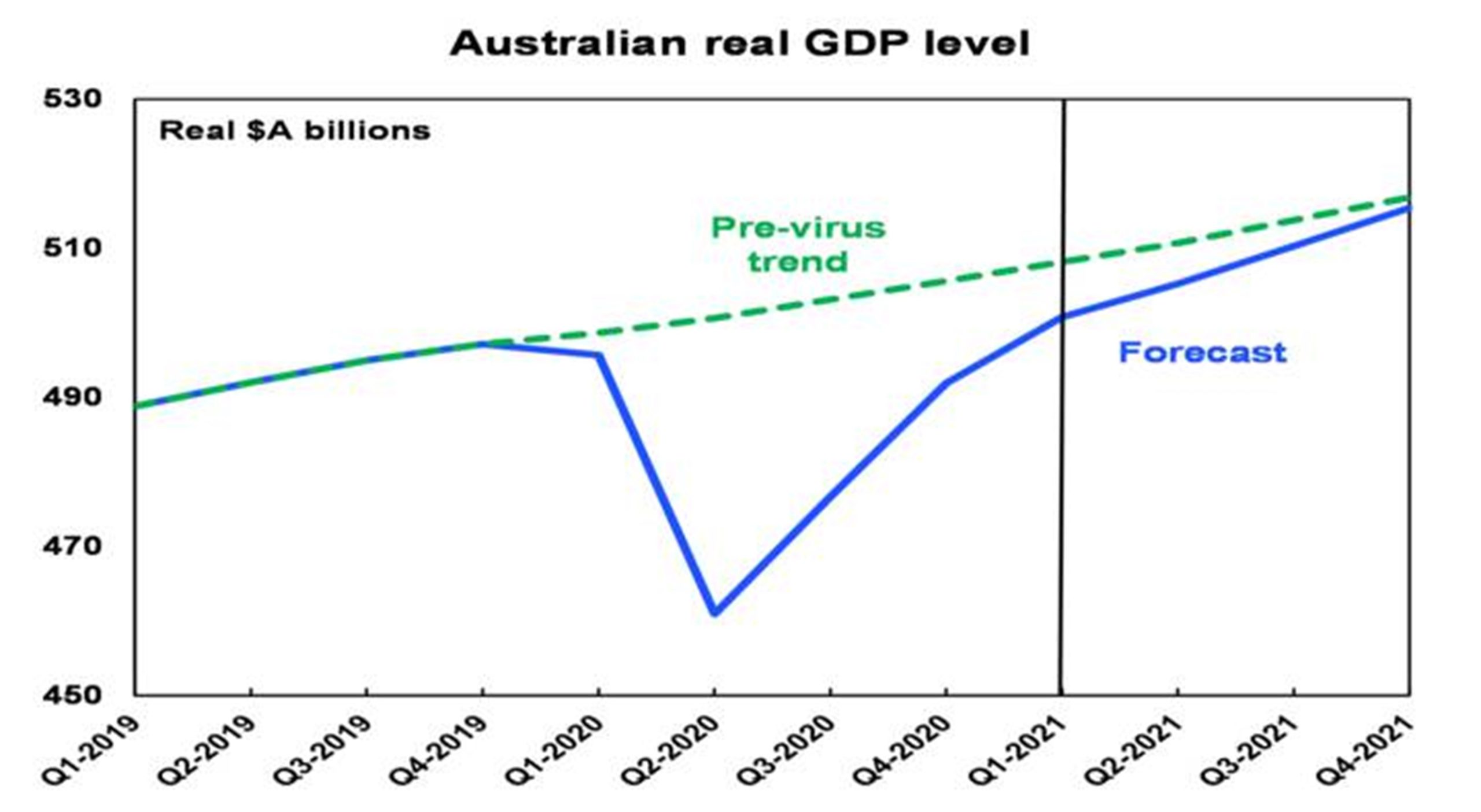

Australia has done really well economically, and its GDP is now 0.8% above its pre-pandemic level in December 2019 (Source: ABS, AMP Capital).

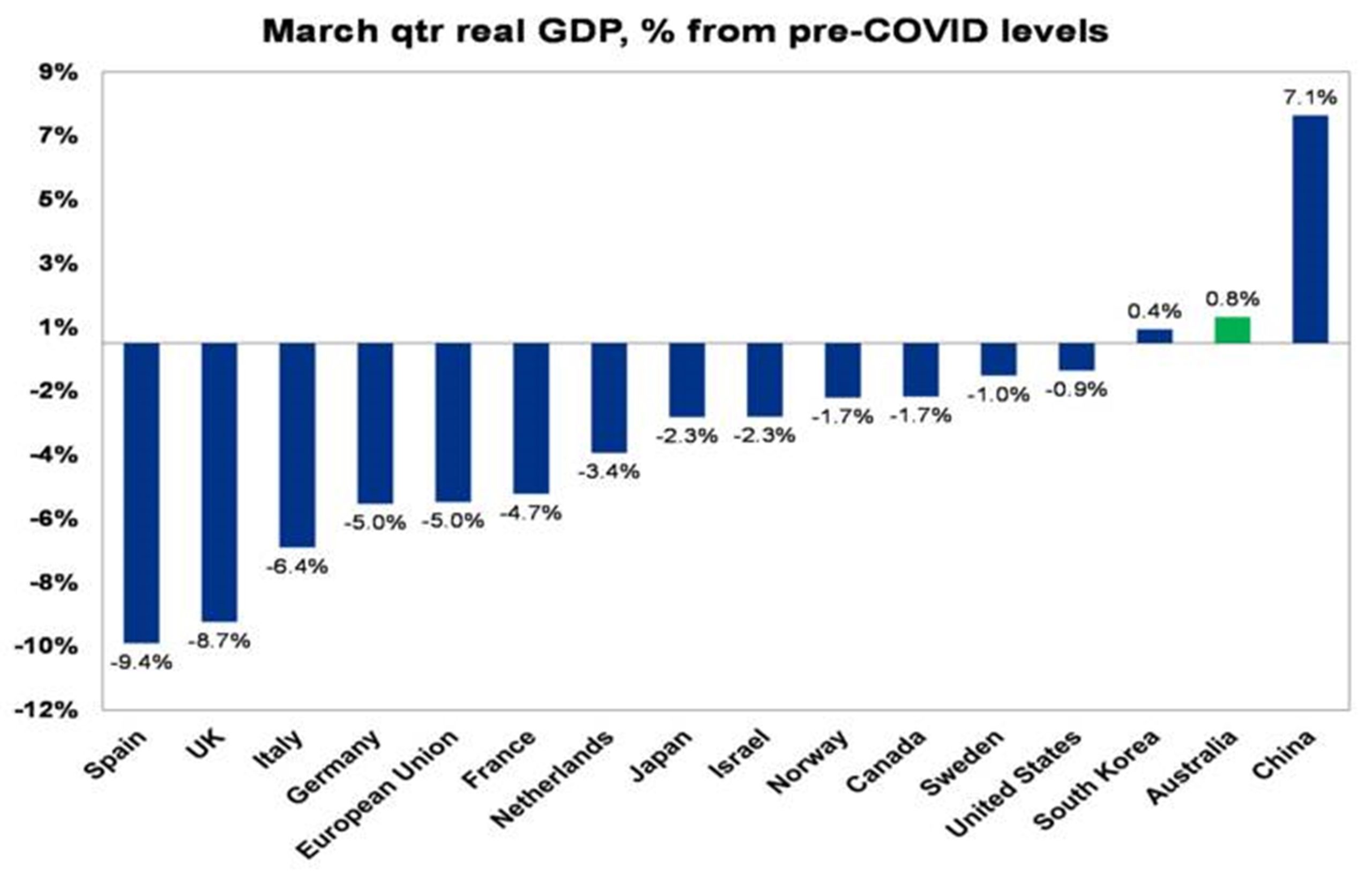

Compare this to other developed countries below (Source: OECD, ABS, AMP Capital) who are also mostly on their way to an economic recovery with China faring by far the best:

As the percentage of the world population who are vaccinated increases, and (hopefully) the spread decelerates markedly, the global economy is set to open, and this will result in an expansion of trade and a resumption of the disrupted supply chains. This should add “more fuel to the fire” with regards to economic boom, certainly in the short run over the next 2 to 3 years.

I leave you all with this quote and wish you all Good Health, Prosperity, and, above all, Happiness!

“You may not always have a comfortable life and you will not always be able to solve all of the world’s problems at once but don’t ever underestimate the importance you can have because history has shown us that courage can be contagious, and hope can take on a life of its own.” – Michelle Obama