I recently attended the Annual Chief Economists’ Forum on Thursday 4th of March organised by Financial Standard.

I recently attended the Annual Chief Economists’ Forum on Thursday 4th of March organised by Financial Standard.

As usual, the line up of speakers was of the highest calibre with Hans Kunnen (Principal and Chief Economist for Compass Economics) as the Master of Ceremonies. The speakers were:

Chris Andrews, CIO and Deputy CEO of La Trobe Financial

Nathan Sheets, Chief Economist and Global Head of Macroeconomic Research for PGIM (Global Fixed Interest Business for Prudential Financial)

Darrell Spence, Chief Economist for Capital Group

Sean Taylor, Chief Investment Officer, APAC for DWS (One of the World’s leading asset managers)

Danielle Wood, CEO of Grattan Institute

You might have heard the saying that if you ask 6 economists’ their views, you will get 16 different views! However, this time around, there seemed to be consensus and the views around markets and GDP’s was largely positive.

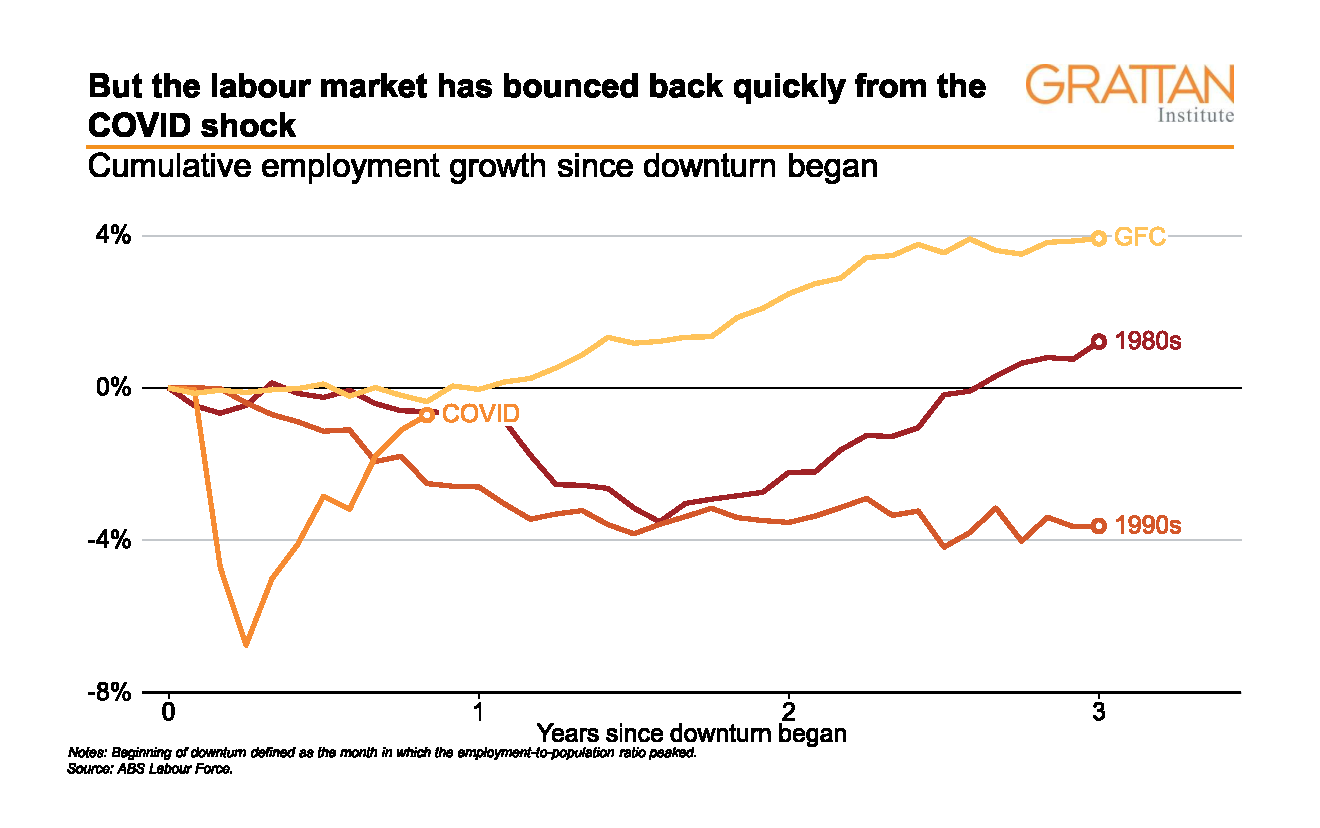

In Australia, there has been a significant labour market rebound, as the chart below illustrates, despite wage growth remaining subdued. This bodes well for the local economy, assuming that the trade tit-for-tat with China does not play into our major exports of iron ore and coal (and it is unlikely to based on the overall view).

However, the real test will come when the jobkeeper subsidies are lifted towards the end of this month. This is likely to result in some business failures and subsequent job losses. There is likely to be an adverse impact in certain sectors such as retail, tourism, education, to name a few. However, institutions such as manufacturing, resources, building, banking, and healthcare are unlikely to be significantly impacted. Industries such as retail, tourism, and education will have further stress due to International border closures as well as potential trade restrictions from China.

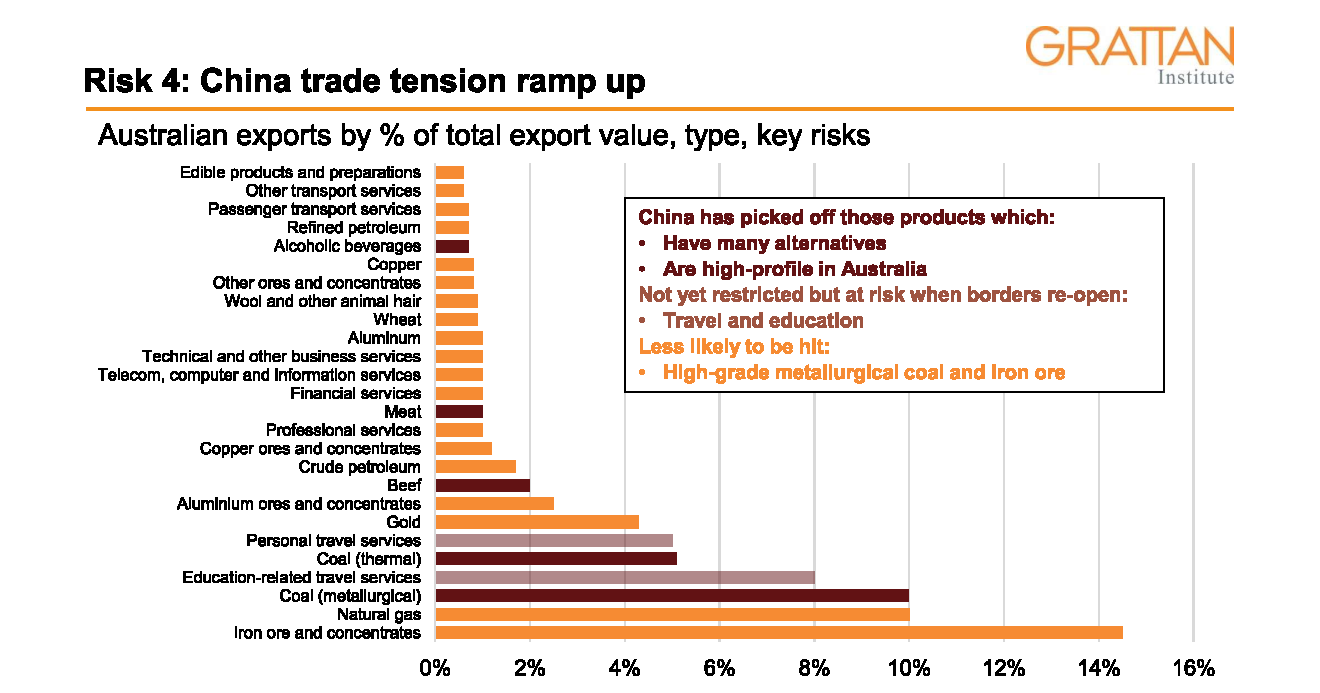

China has been very careful to select those goods that have other sources than Australia but are high-profile to apply tariffs or blockages upon to “punish” us for raising legitimate concerns around the transmission of covid, human rights’ issues, South China Sea border issues, and offcourse Hong Kong.

See chart below of the impact on goods so far from China’s application of tariffs and blockades of our exports.

The US lead by Joe Biden and strongly supported by Janet Yellen (Treasury Secretary) and Jerome Powell (Fed Chair) in maintaining the fiscal stimulus until the US has full employment will “jump start” the US economy. We hope that our leaders will follow the US example in this endeavour. In addition to the stimulus, Joe Biden is likely to manage the trade War with China better (despite keeping the pressure on with regards to human rights, South China Sea border dispute, Hong Kong, etc.). This should ease the tensions somewhat and be a net benefit for Australia in our relationship with China.

Despite the geo-political risks with China as well as our trade spat, a steady employment and historic low interest/mortgage rates have resulted in the largest residential loan approvals in 65 years causing a significant house price appreciation in Australia. This provides us Australians with a “safety-net” of wealth appreciation and household savings have also improved during the covid period. This should encourage spending in most cases and hopefully provide a boost to our economy.

Given the successful deployment of the Covid vaccines globally (especially the US and UK) and extremely loose monetary policy and huge fiscal stimulus globally, markets have overlooked the near-term volatility as well as the risk of mutations of the virus and focussed on the future recovery. This has resulted in China and Emerging markets leading the recovery followed by the US, Australia, and finally Latin America.

However, with anything, there are always two sides to the story. The reverse side of this story is the risks of governments withdrawing stimulus before we reach full employment; overcoming the mountain of government debt; mutations of the virus making the vaccines ineffective; trade war exacerbating between China and the US and with repercussions for Australia; and inflation suddenly accelerating resulting in reserve banks increasing interest rates prematurely. In addition to the above, extended border closures will impact certain parts of our economy such as retail, tourism, and education sectors which rely heavily on migration and new entrants each year.

Most recently, we have seen the negative movement in equity markets caused by inflationary fears which saw the bond rates increase globally. Despite the 10-year rate having increased from its lows, equity markets have now virtually recovered from the recent falls last week, as the US heavy weights such as Janet Yellen and Jerome Powell having appeased the markets that they will keep the stimulus going until there is full employment and the US economy is back to growth. Whilst the South African strain of the covid virus has caused concerns, it has not had a material impact on equity markets which seem to be focussed on a global recovery. It appears, and there was consensus across the various economists, that markets will continue to improve in 2021 whilst interest rates will remain low for at least the next 2 to 3 years or possibly more. After this, things might start to look more concerning and it will become ever more important to remain diversified and be more discerning about where we invest from a tactical perspective.

For now, I am looking forward to most of us receiving our covid vaccine this year and hoping for borders safely re-opening from 2022 onwards, assuming the vaccines remain effective against all strains of this virus.

Stay safe and stay well!