Back in June Newsletter, I wrote an article on what would be the impact of the COVID-19 pandemic on the Australian housing property market

At the time, the social and financial impacts of the outbreak was starting to flow through the Australian economy. The Australian economy has subsequently experienced its first recession in 28 year, a national unemployment rate of 7%, and wages down 4.3%. During this time, there was general consensus that property prices would weaken with some commentators suggesting that Australian property would fall by up to 50%.

However, between March and October, Australian home prices fell just 1.4% with October marking a 0.4% increase in value with the trend suggesting further acceleration in growth.

So why did the housing market hold up so well?

Not everyone lost their job

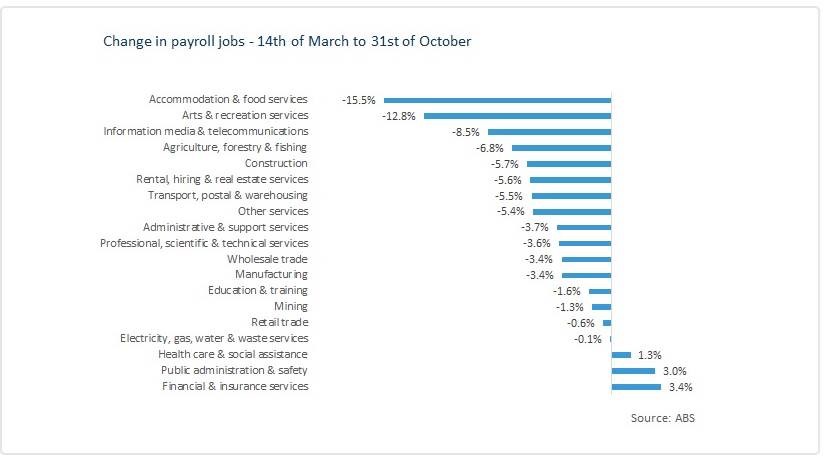

This pandemic induced recession was different to others in that not all sectors were impacted. In this recessions, the largest job losses were experienced in the hospitality, tourism, and arts industries.

Generally, people working in these industries were less likely to have a home loan. However, there is evidence that it contributed to pockets of rental income decline, particularly in areas close to CBD’s.

Generally, people working in these industries were less likely to have a home loan. However, there is evidence that it contributed to pockets of rental income decline, particularly in areas close to CBD’s.

Despite the fall in income, government fiscal measures such as job keeper saw household gross income rise 2.2%pa in the June quarter. This contributed to a $42 billion rise in Australian household net saving and creating the biggest quarterly savings buffer since the mid 1970’s.

Repayment Holiday

With the support of the Federal Government and Regulators, a mortgage deferral scheme was introduced in March. Under this scheme, Banks effectively gave borrowers an option to pause their loan repayments for up to 6 months.

It has been estimated by the RBA that for every 100-basis point rise in unemployment, this would contribute towards a 80 basis point increase in the portion of mortgages going in arrears. Ongoing arrears would lead to enforced sales, which in turn would contribute to lower values.

This introduction of a repayment holiday was an important strategy in cushioning the effects of ongoing loan arrears by forcing distressed borrowers to forcibly sell. At its peak in May, some 11% of total home loans were part of the scheme. By September, this reduced to below 7%. Whilst the Banks have extended the repayment holiday for a further 3 months to January for clients in need, reports from lenders have suggested that most loans have returned to a performing status.

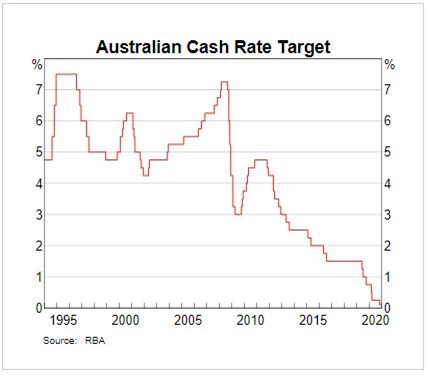

Lower Interest Rates

Over the course of the pandemic, the RBA reduced the official cash rate from 0.75%pa to a record low of 0.10%pa.

As interest rates fall, it creates an extra capacity to borrow. With fixed interest rates now being less than 2% for owner occupied loans, lower interest rates have stimulated demand, particularly from new home buyers. With interest rates expected to stay low for some time, those with secure employment will be more confident to borrow and thereby providing continued support to property values.

Where to from here?

The Pandemic recession has caused some corrections, particularly in Melbourne and in inner-city units, however the Australian property market has been pretty resilient. Improved business conditions, rising consumer sentiment and lower interest rates, are all likely to support the Australian housing market in the immediate term.