With the social and financial impacts of the COVID 19 outbreak being felt throughout the Australian community, a lot of questions are being asked what will be the effects on the residential property market.

With headlines forecasting property prices could fall by 50%, it was interesting to read the most recent Property Market & Economic Review written by Eliza Owen Head of Australian Research at CoreLogic Australia,

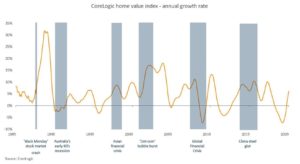

In the report, it notes that Australian residential property has historically fared well against negative economic shocks. As per the graph below, recessions and major share markets losses are not necessary predicators of declines in housing value. As an example, the 1987 ‘Black Monday’ stock market crash saw the Australian share market lose approximately 23% of its value in a single day, housing values were largely unaffected.

In the ‘ recession we had to have’ of the early 90’s property values declines by -4.4% from June 1989 and to October 1990. Post GFC, where the economy was more global, property values declines -7.6% from February 2008 to January 2009. However, an uplift in mining-related investment and the start of a rate cutting cycle by the RBA, saw a swift recovery. Recently, property values have been more reactive to structural changes in the lending space, particularly relating to investment properties.

What is happening to residential housing amid COVID-19?

At the moment there are no clear signs of distress in the property market. To date, capital city housing values have only shown a mild slowdown.

Why is that? Property prices do not decline in the same way as shares during a downturn. Shares can be sold quickly however most housing is relatively illiquid and can takes months to sell.

As the COVID-19 downtown is seen as short-term, many vendors are deciding to delay the sale of their properties rather than risk a lower price. This has led to the reduction of housing stock which is about 25% lower now than this time last year.

In the short term, rent prices are more likely to be affected than property prices. CoreLogic recorded a -0.4% decline in rent prices nationally across Australia over April. Rental markets have been particularly dampened by falls in employment, particularly in the accommodation and food services, arts, and recreation services; all industries where workers are generally young, on less income and more likely to rent. The tourism restrictions have also meant that housing previously used for short term rentals such as through Airbnb are now being let out for longer term rent, thereby increasing the supply or rental properties.

Conclusion

In the short term, we will see a reduction in rental prices as the supply of rental properties become available. Property values will be supported as vendors withdraw housing stock for sale, again reducing the supply available for new purchasers.

Government fiscal support through measures like Job Keeper and regulatory measures which allow home loan repayment pauses for up to 6 months will support households experiencing financial distress and avoid forced sales.

There are some however clear downside risks. The current high levels of household debt intensify the risk of unemployment on housing market conditions.

Whilst Australian housing has shown to be less volatile and slower to respond to economic shocks than equities, it is tied to the fundamentals of economic and income growth. How resilient the Australian economy is, and its ability to rebound will be the key. However, with new information and policy responses unfolding daily, forecasting the longer-term impacts of to the Australian housing market remains uncertain.