Markets have continued to rally and the US S&P index has just turned positive for 2020 by 0.05%. This is due to the backdrop of a much smaller unemployment number than what was anticipated printing at just under 14% as opposed to the expected 19% figure in the US as initially touted when the pandemic took hold in the US.

Global markets have also continued to follow the US and have rebounded off their lows and not too far off the highs hit in February this year. The Australian market has also been a beneficiary. A rising demand for iron ore due to depleting reserves in China, and their continued focus on infrastructure spend to shore up economic growth, has also strengthened the Australian dollar.

This rally in equity markets is despite covid-19 numbers still increasing in the US, Europe, and parts of Central Asia, Middle East, and Africa. The latter regions neither have the resources nor the capacity to practice social distancing and avail testing of any significance to avert this pandemic. That is worrying to put it mildly.

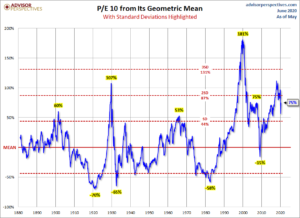

The price of eq uity has been trending up given the recovery and now sits above longer-term averages. Yes, there is an argument that this is also further exacerbated by the low inflation environment causing the P/E ratios to appear somewhat inflated.

uity has been trending up given the recovery and now sits above longer-term averages. Yes, there is an argument that this is also further exacerbated by the low inflation environment causing the P/E ratios to appear somewhat inflated.

Based on the chart above, we are about 75% above the geometric mean of historic P/E ratios illustrating a somewhat expensive market. Therefore, the risk of a correction is ever increasing the longer the rally continues.

Whilst we remain invested for the most part, as we do not know when this rally will come to an end, and hence we are also keeping our powder dry for our client portfolios to take advantage of any downturn, should the market revisit the March 23rd lows again. Most of this ‘dry powder’ has come at the expense of fixed interest and defensive allocation within our portfolios.

We are keeping a keen eye on market developments with the view to take advantage when the opportunity arises at some point in the future.