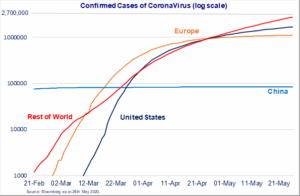

Just to provide a quick virus update (but please remember that these numbers change daily).

Current global cases of COVID-19 stands at 5.56M with an additional 64,000 cases overnight. This latest increase makes it the 57th occasion over the past 58 days where the numbers have increased in excess of 60,000. Interestingly, it took 73 days for the cases to reach 1 Million, 13 days to reach 2 Million, and 11 and 12 days for it to increase to the current level. However, thankfully the growth rate of daily confirmed cases is trending lower despite higher testing.

Despite the virus numbers still climbing globally and new hotspots emerging around the world (Southeast Asia, South Africa, latin America), equity markets have continued their upward momentum.

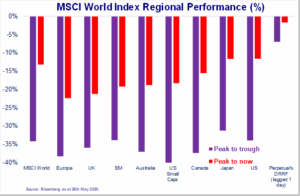

Looking at equity market peak in February 2020, most markets are still below that level with varied results. Australia is still around 18% below its February peak whilst the US and Japan are only about 12% below their peak. See the chart below:

Interestingly, the major market recovery in the US has been largely attributed to the 5 tech stocks (the “magnificent 5”) which are Apple, Microsoft, Alphabet, Facebook, Amazon which collectively account for over 18% of the S&P 500 in the US.

Overnight, President Trump has increased his rhetoric on blaming China for the virus and wanting to clamp down further on trades and security issues. Given the election is around the corner in November, it would be logical to see this pressure increase from Trump to take the spotlight off the poor handling of the covid virus spread in the US. This will increase global trade at a time when border closures are already forcing countries to become more insular, at least in the short term.

We believe that the positive sentiment of the US states opening up their economies sooner than anticipated; the tremendous economic stimulus that has been deployed globally; and the expedience of the human trials for a Covid-19 vaccination has created a tail wind for equity markets resulting in a rally over the past few weeks.

We saw Hertz in the US file for bankruptcy last week and we expect many more business failures to come through in the coming months on the back of the covid-19 closures. This will result in substantial job losses globally in our view. Furthermore, the globally economic recovery will take, again in our educated view and looking back at history, a good 2+ years to recover. Generally, equity markets are forward looking by about 6 to 8 months. However, in this instance in our view, they seem to have overshot the mark and there is strong probability of a relapse. We remain cautious whilst still leaving our equity exposure intact. However, we are ready to act with a decent amount of dry power in our portfolios should the opportunity arise and markets test the March 23rd lows again.