During the GFC, markets took 47 weeks to lose 38%. This time around, it took just 4 weeks from peak to trough to lose 38%!

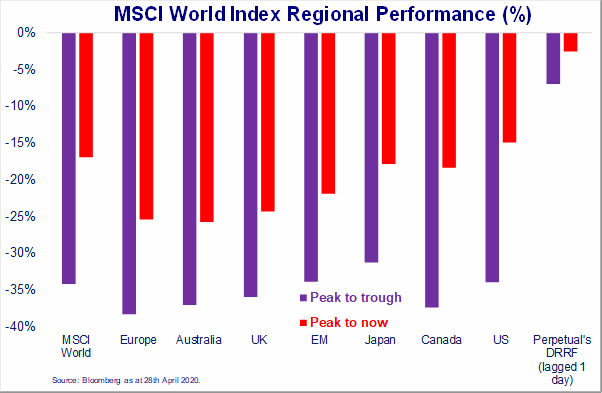

Markets have recovered around half of the downturn experienced in March culminating in a speedy recovery of approximately 15-20% in the past 2 weeks. Overall, markets are still down around 18% to 20% depending on geographic regions and asset class. See the chart below:

This is being driven by positive sentiment around the enormous stimulus packages that Central banks around the globe have coordinated their efforts on. In addition to this, most recently, the markets are taking solace in the fact that some of the states in the US are looking to reopen their economies. This is despite the fact that the Covid-19 virus has not slowed down in the US (other than some states) with total deaths in the US at 50,000 and increasing daily. Cases around the World now stand at over 3 million and climbing!

US quarterly reporting starts this week. However, it is important to keep in mind that the quarter that is going to be highlighted is the January to March 2020 quarter where the impact of the closures from the virus only just started in March. I believe the following reporting quarter (April to June) will show the true impact of the economic slowdown.

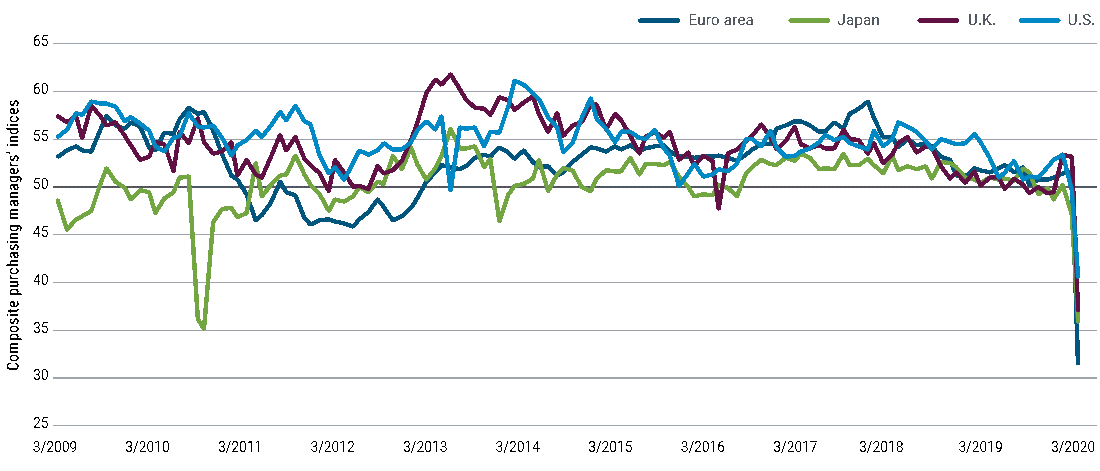

The chart below, courtesy of PIMCO, Haver analytics, on the Purchasing Managers’ Index (PMI), clearly illustrates the numbers falling dramatically in March. I would envisage this would look worse in April and, depending on when severe restrictions are lifted in Europe, UK, and the US, it might deteriorate further in May.

It is likely that, based on further relaxing of social distancing rules around the globe and some economies reopening, markets may continue to run up. However, we believe that the speed and depth of the recovery, in the absence of a cure for this pandemic, and notwithstanding the resultant economic pain yet to be realised in company and GDP reporting, is premature. This than leads us to believe that the equity markets may, once again, see the lows we had experienced in late March before we make a full and sustained recovery in due course.

Therefore, in conclusion, we are keeping our powder dry whilst retaining existing exposure to quality managers and equity holdings. We will look to deploy further capital towards increasing equity exposures when we see further downside. Off course, this is our view based on research and looking at historic equity market reactions during times of downturn, where volatility is the only certainty. Markets may shrug off negative reporting sessions and continue along its merry way. However, we believe the probability of this is low and caution is certainly warranted in these times. I leave you with a couple of quotes from Warren Buffet:

“Volatility is an opportunity; forget the news and invest for the long term” and

“Widespread fear is your friend as an investor because it serves up bargain purchases”

DISCLAIMER: This email is sent by or on behalf of the named sender identified above. If you do not wish to receive any email marketing material from me in the future, please forward the contents of this email to gulzar@elixirwealth.com.au, with the message “unsubscribe” in the subject box.Advice in this email may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. You should consider your personal circumstances before proceeding.Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.The material contained in this email is based on information received in good faith from third party sources, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate.

Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.