To say markets are volatile would be an understatement. However, I hope all the write-up and phone calls are keeping you informed and hopefully alleviating as much concern and worry as possible. Let me worry for you so that you can take the stress out of your lives!

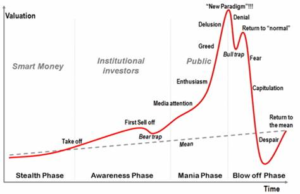

Here is an interesting chart of human investor behavior through various equity cycles:

It is also very important to keep in mind that history does repeat itself and the chart above has held true through most of time.

John Maynard Keynes was a noted investor as well as a great economist, and he said:

“Slumps are experiences to be lived through and survived with as much equanimity and patience as possible. Advantage can be taken of them more because individual securities fall out of their reasonable parity with other securities on such occasions, than by attempts at wholesale shifts into and out of equities as a whole.”

Markets live through these cycles all the time and often, other than fundamental reasons, there are what are know as ‘Black Swan’ events which act as catalysts for corrections. This time around, it has been the Coronavirus or Covid-19 that has been the catalyst. The World we live in is now far more connected than ever before! Hence the depth and speed of the virus spread has been so catastrophic.

In the past week, the impact of this virus has been extenuated further with the developing oil price war between Saudi Arabia and Russia. While reduced energy prices are generally good for industrial economies, there has been a negative impact on the valuation of the US domestic energy sector which is now a net exporter of energy. This will continue for some time as the Russians are attempting to economically squeeze the American shale producers and the Saudi’s do not want to cede market share to Russia or the US.

The key question is how deep and long-lasting the recession proves. If companies and individuals can keep afloat during temporary shutdowns, the economic downturn is likely to be shallow, and low interest rates can promote a swift recovery, as do lower oil prices. However, the affects could be longer lasting depending on government stimulus and impact.

Central banks and governments around the world are coordinating a ‘war-time’ like offensive against this virus and its economic impact. How this plays out will determine how quickly we recover from the economic woes that has been brought on by this virus.

Looking at some stats:

50% of Americans will contract the virus (150m people) as it’s very communicable. This is on a par with the common cold (Rhinovirus) of which there are about 200 strains and which the majority of Americans will get 2-4 per year.

70% of Germany will contract it (58M people). This is the next most relevant industrial economy to be affected.

Peak-virus is expected over the next eight weeks, declining thereafter.

The virus appears to be concentrated in a band between 30-50 degrees north latitude, meaning that like the common cold and flu, it prefers cold weather. The coming summer in the northern hemisphere should reduce the incidence of this virus.

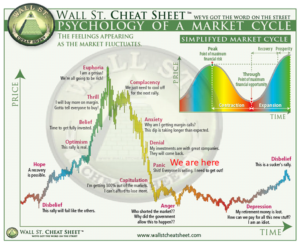

There will be economic damage from the virus itself, but the real damage is driven mostly by market psychology. See chart below.

However, we will prevail and come through this downturn in due course by remaining level-headed and taking a longer-term view as well as sticking to our asset allocation strategies. We expect to see markets starting to recover from the second half of this year. Economies will take longer but markets are generally forward looking.

We have been somewhat defensive (in hindsight should have been more) over the past 6 or so months. We are now looking to move our portfolios, where possible, back towards the longer-term risk profile and getting greater exposure to equity markets. However, we are looking to do this with the view to tilt towards equities when the virus is closer to the peak as this will provide greater clarity on timing and breadth of the virus’ impact and eventual recovery of markets.

As always, please feel free to contact us if you have any concerns or simply wish to have a chat. Your team at Elixir is at your disposal!

P.S. Please feel free to share this write-up with your loved ones, as well as friends and colleagues, if you think it will help to put their minds at some ease.