Markets have had a substantial correction today on the back of the coronavirus spreading to other nations coupled with the breakdown in talks between the Saudis and Russian to curb oil production. This has caused oil to drop by about 10% as Saudi Arabia ramps up production in retaliation to Russia.

With regards to the Coronavirus, China (ex-Hubei province), Singapore and Taiwan were among the first countries affected and are guiding expectations elsewhere in the world. In these countries containment measures have resulted in a mortality rate of 0.7% versus 5.8% in Hubei. The number of new daily cases is now falling in these countries.

The trade-off has been a virtual economic shutdown for an extended period, resulting in loss of trade. If other governments follow this lead to contain the spread of the virus, the question becomes how long and severe the downturn in each economy lasts. Further widespread rate-cuts look likely and there are details emerging on various stimulus packages globally. In Australia there is talk of $5 billion in government spending including measures such as reduced deeming rates for pensioners, funding for small business, and perhaps tax concessions for small businesses.

If countries can normalise economic activity without a spike in infections, the economic pain may be short-term and manageable with government stimulus.

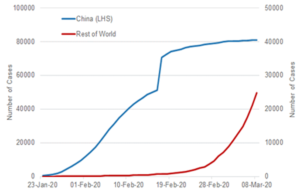

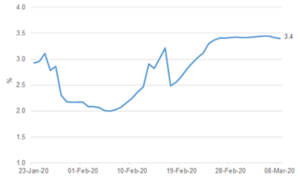

As of 8 March, the number of infections have plateaued in China. China had only 46 new cases, assuming this is correctly reported. Infections in South Korea have also slowed in the last few days from 518 to 367 a day. However, Globally, daily infection and death rates are still trending higher, led by countries like Italy (1,247 new cases) and Iran (1,076). A record 101 countries are now affected. The mortality rate remains stable at 3.4%.

NUMBER OF DAILY INFECTIONS

The spike in February was due to the change in methodology in how cases were being confirmed.

MORTALITY RATE

Source of Charts Above: WHO, Johns Hopkins CSSE. As at 8 March 2020.

The question is can other countries be as drastic in confining their population to curb the spread of this virus as China has managed to do. Whilst there is significant funding to find a vaccine, it is, unfortunately, probably many months away (some say between 8 and 10 months).

In the US, Apple is now asking staff to work from home and Uber has committed to compensate its drivers who contract the illness with 14 days of pay whilst they isolate. The US is looking at a substantial stimulus package as well to help alleviate the slowdown in trade due to the onset of the virus.

European union is also considering a stimulus package in addition to trying to convince the banking fraternity to lend to businesses, especially small business, to help during these trying times.

It is hard to put a finger on how quickly this current issue will take to come back to normal trading and economic conditions around the globe. We are still of the view that it will take 2 to 3 months before this virus starts to plateau (probably the same in Australia) globally. This means normalised business conditions should start to return from July onwards and markets should also follow suit. However, there is no certainty around these time frames.

Our portfolios are structured with quality being at the forefront. Panic selling only crystallises losses. Let history be a guide as most downturns are followed by a recovery –timing is always the missing link in the equation.

Like Warren Buffet said:

“The stock market is designed to transfer money from the active to the patient.”

“Remember that the stock market is a manic depressive.”

Always stay rational.

Therefore, importantly, it is times like these when taking a longer-term view and turning down the noise is most beneficial in preserving your capital.