I had written last week about the potential for a market correction based on this ‘x-factor’ of the coronavirus as an opportunity for the markets to take stock and remove some of the froth. Markets have had a strong run over the past 12 months where valuations are somewhat stretched. Any bad news, even where driven by sentiment, will cause markets to react negatively. The coronavirus, however, is not just sentiment driven as it will have serious repercussions on global GDP based on supply chain disruptions, amongst other things.

I had mentioned the disruption to the global supply chain from the shutdown of manufacturing activity in China in my write-up last week. This is now taking hold, and the equity markets have woken up to it as witnessed in the decline over the past two days.

Let us revisit the coronavirus based on current numbers. Albeit the number of reported cases now stands around 80,000 globally, the good news is that the number of daily cases is down from the peak earlier this month. This is despite the fact that China changed the methodology from reporting lab confirmed results to clinically tested results and now back to lab tested results only. See the chart below:

Source: PRC National Health Commission, Bloomberg, AMP Capital

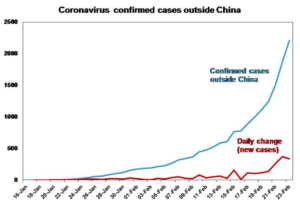

The unfortunate and worrying issue is now the spread of this disease outside China with new incidences in Iran, Italy, Japan, South Korea, and most recently Spain. See the chart below:

Source: Bloomberg, AMP Capital

There is still significant uncertainty about how this illness is spread and hence confusion on how it can be averted. Containment measures in China have been extremely aggressive and, based on the declining cases, seems to be working. Consensus is that this will be contained by the end of March and we are hopeful that this eventuates as expected. Worse case scenario would be a global pandemic, in which case markets could see a significant correction (around 20%).

The estimates suggest that 50% of the Chinese economy has been in lockdown resulting in about 12% knock-off effect on their GDP. Numerous companies globally are reporting disruption to supply chains as well as reduced demand flowing from Covid-19 (coronavirus).

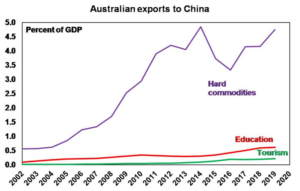

Australian GDP will go backwards this quarter due to the impact of Covid-19 as well as the unfortunate bushfires in tandem. Exports to China make up about 9% of GDP. This includes hard commodities, tourism, and education. For other major economies, it is less than 3%. This rising threat to the Australian economy might lead to the RBA cutting rates next month and again in April this year. See the chart below:

Source: ABS, AMP Capital

We don’t believe that this is that start of a bear market but an overdue pull-back based on equity market run up over the past 12 months and somewhat stretched valuations. The Covid-19 has been a catalyst for a market reset to more reasonable valuations. During the SARS pandemic (Covid-19 is not yet a pandemic), the ASX200 fell about 12%. So far, the market is down 5% (as of today, February 26th).

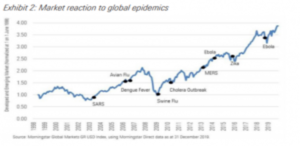

Since the SARS outbreak in 2003, the Ebola virus in 2014 and 2016, and a bout of Zika in between the these, the outbreaks have been contained eventually, and markets have paired back losses. Sentiment drives early losses. However, these are not sustained, and markets tend to recover within 6 months. See the chart below:

Therefore, this is not the time to crystallize losses and seek refuge in cash. It is a time to “turn the noise down” (or off), and stick to your long-term asset allocation strategy.